Rep. Titus calls for change

Titus posted her letter to her X (formerly Twitter) account.

The letter, addressed to Rep. and Chairman of the Committee on Ways and Means Jason Smith, the letter encourages lawmakers to revert the “unfair” 90 percent standard that “negatively impacts professional and casual players.”

“While the change may appear minor, it will have significant and harmful consequences,” the letter reads. “It unfairly burdens professional gamblers and casual players alike and will inevitably drive players toward offshore and unregulated markets where consumer protections are nonexistent, thereby undermining responsible gaming efforts nationwide.”

The 90 percent deduction change was included in President Trump’s Big Beautiful Bill, which was signed into law on July 4.

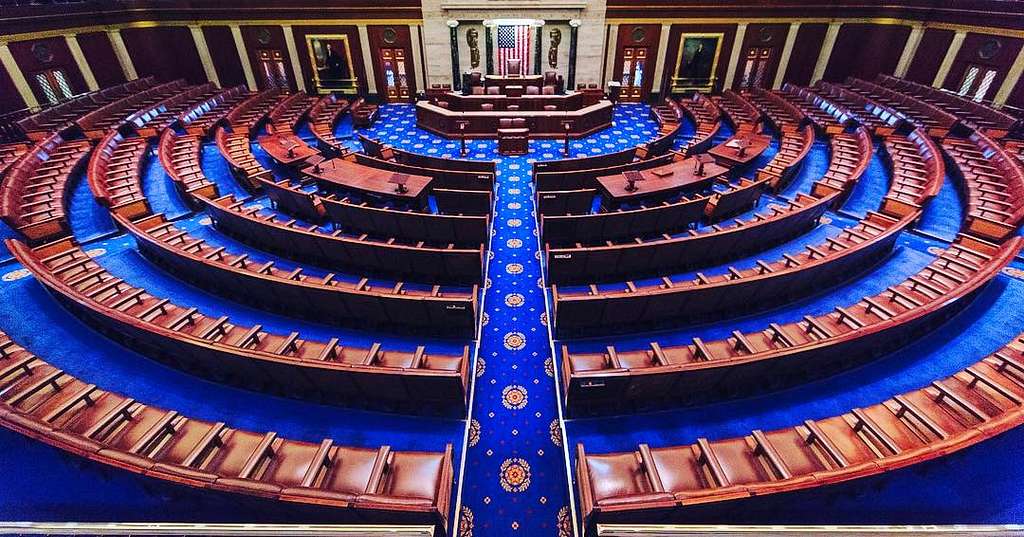

The FAIR BET Act was initially referred to the Ways and Means Committee on July 7. It was stuck there during the duration of the government shutdown, but Titus is still hoping to have it approved before the end of the legislative session.

“Support for this fix has been both strong and bipartisan,” the letter states. “The legislation also enjoys broad industry support, including from the American Gaming Association, MGM, DraftKings, FanDuel, Caesars, Wynn, the Nevada Resort Association, and the National Thoroughbred Racing Association.”

Strong support

To understand the difference between 90 and 100 percent deductions for losses, suppose that a gambler bets and wins $100,000 each, resulting in $0 in profit.

If 100 percent of losses are deductible, that individual would finish the year the same way they started it. If that number is dropped to 90 percent, they would have to pay taxes on $10,000, despite not taking home any additional profit, and changing it to a net-negative year.

Derek Stevens, owner of Circa Sports and several Las Vegas casinos, on Thursday posted a video on X championing the FAIR BET Act.

“I don’t know a single member of the U.S. House of Representatives or a single U.S. senator that wants this to go into action on Jan. 1,” Stevens said. “We were asked by the chairman of the House Ways and Means Committee, please call your U.S. senator, please call your member of the U.S. House of Representatives; there’s only a few days left.

“This change impacts the entire hospitality industry, the tourism industry, all of our employees, which is critical, as well as most of America, which has made a bet in the last year.”

President Trump earlier this week said that he would consider eliminating the federal tax on gambling winnings. If he followed through on that, it would still only help bettors who won more than they lost.

.svg)