Reaching a resolution

The suit was presented by the Wisconsin Institute for Law & Liberty on behalf of the American Alliance for Equal Rights (AAER), Phillip Aronoff, and Richard Fisher. The two men wanted to take advantage of Bally’s IPO but were barred by their “immutable characteristics.”

The terms of the settlement, reached in the U.S. District Court for the Northern District of Illinois, were not released.

“Plaintiffs have settled with Bally’s Chicago Inc. and Bally’s Chicago Operating Company, LLC,” a court filing read. “It is hereby stipulated and agreed between Plaintiffs American Alliance for Equal Rights, Richard Fisher, and Phillip Aronoff, and Defendants City of Chicago, Bally’s Chicago, Inc., Bally’s Chicago Operating Company, LLC, Sean Brannon, Stephan Ferrara, Dionne Hayden, and Charles Schmadeke, that all of Plaintiffs’ claims in this matter are hereby dismissed with prejudice, with each party to bear its own costs and attorneys’ fees.”

Bally’s minority-centered policies were mandated by the agreement it reached with then-mayor Lori Lightfoot, who said that at least one-fourth of the casino’s shares must’ve been held by minorities.

The IPO was reworked in April to favor Chicago and Illinois residents. Its outgoing minority requirement represented a form of the diversity, equity and inclusion policies that the Trump administration has focused on eliminating.

A series of unfortunate events

The path for Chicago’s first casino has been anything but straightforward, whether it be the legal battles, construction hold-ups, or a recent scandal in which development was paused due to Bally’s hiring an unapproved trash company with ties to the mob.

“Bally’s illegal and divisive investment plan is dead,” Dan Lennington of the Wisconsin Institute for Law & Liberty said. “From the beginning, this investment plan raised serious legal and ethical concerns and has since been abandoned.”

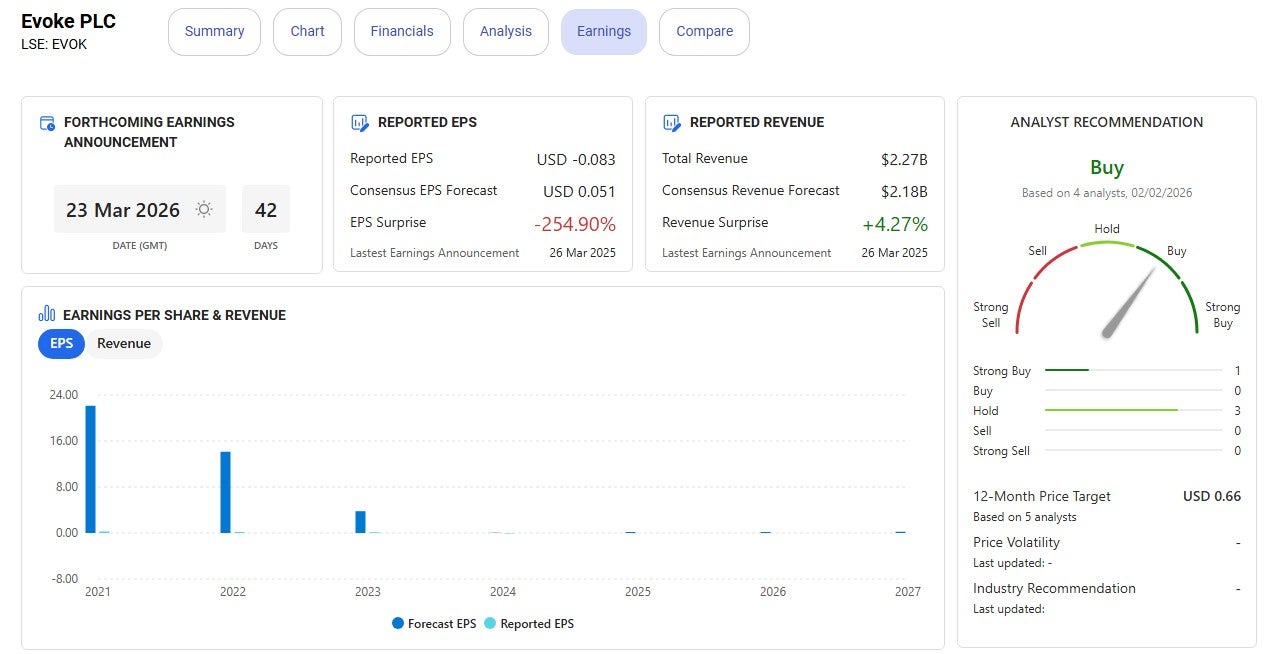

Bally’s in March notified prospective share-holders that it risked incurring substantial legal costs if it did not rework its minority requirement, which had stalled at the hands of the Trump-led SEC.

The company, however, still has a 25 percent minority ownership clause in its contract with the city of Chicago.

Bally’s stated that its Chicago casino shares are “highly risky” and “should be considered only by persons who can afford the loss of their entire investment.”

The company’s temporary facility in Chicago has been a disappointment in recent times and failed to produce more wins than losses. The company is still hoping to meet the scheduled late-2026 opening for its $1.7 billion full-time facility.

.jpg)