Economic Lifeline at Stake

Rep. Titus' bipartisan FAIR BET Act seeks urgent legislative change before year-end, pushed by unified support from Nevada's House delegation. "Members on both sides of the aisle have heard you," acknowledged Rep. Jason Smith (R-MO) during the Las Vegas hearing, a sign of cross-party alignment. Titus emphasized broader ripple effects, noting that the new bill "has other implications for the industry besides just at the gaming table."

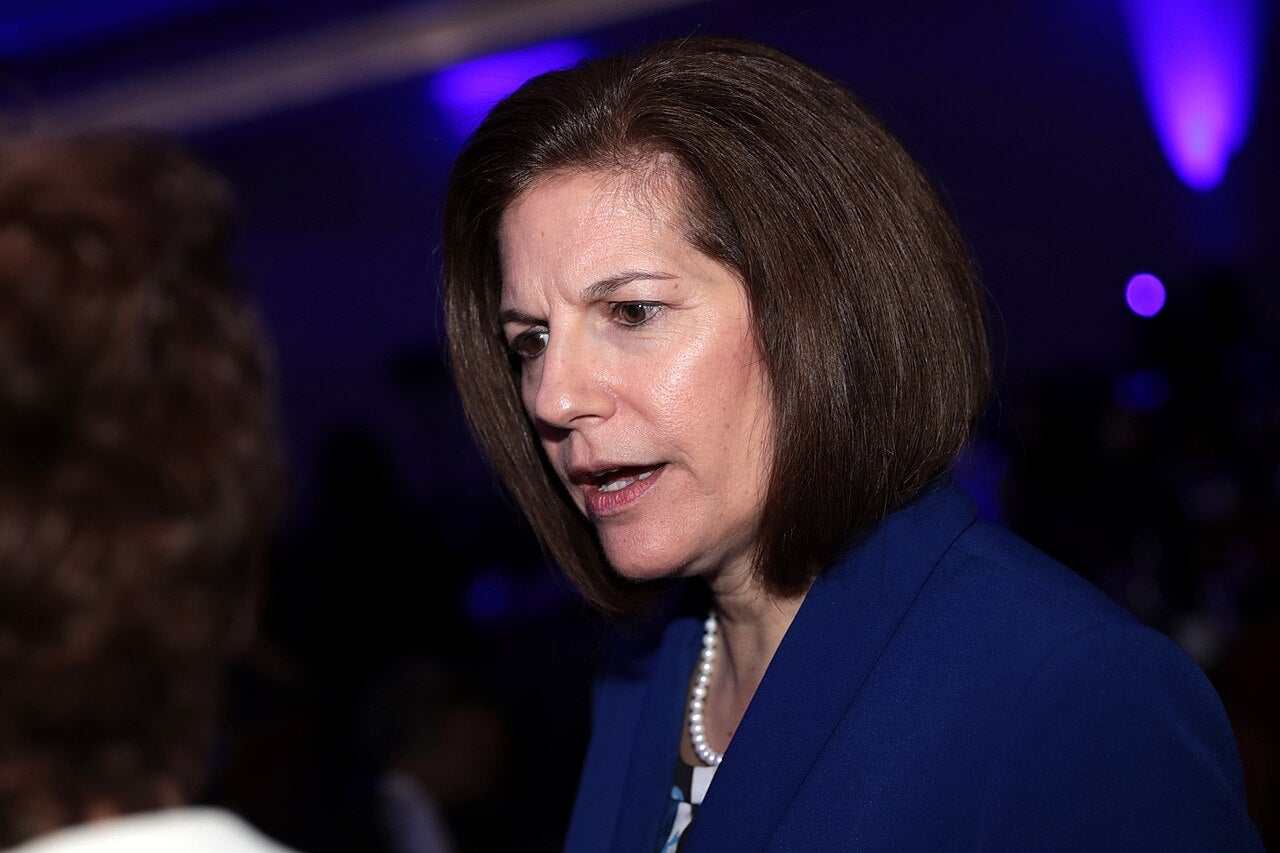

The FULL HOUSE Act, introduced by Senator Catherine Cortez Masto (D-NV), amplifies pressure for the provision's reversal amid a Vegas tourism slump, with 11% fewer visitors and 7% lower Strip room rates compared to 2024. High-rollers are already exploring alternatives like Kalshi, a CFTC-regulated platform, which CEO Tarek Mansour describes as "trading" and not gambling.

Call for Change Gains Traction

Nevada Resort Association President Virginia Valentine warned that the tax provision undermines casinos' main promise of fair taxation, highlighting concerns over gamblers fleeing to the offshore market. One high-stakes gambler at Titus' town hall hearing revealed he shifted $10 million in annual bets offshore, lamenting the lack of legal recourse and tax revenue losses, stating, "It's a lose-lose for all of us."

The FAIR BET Act now has 10 bipartisan co-sponsors, with Rep. Jason joining repeal efforts. Some GOP senators claim they were unaware the tax change was embedded in Trump's bill, a disconnect Titus compared to "the arsonist saying, 'Let me help you put the fire out.'"

Tax Reform Pushback

DraftKings CEO Jason Robins explained the new cap "doesn't make sense. If you can't deduct all your losses, you know, how does that make sense that you pay income tax on something that's not actually income." Robinson, from American Bettors' Voice, warned the policy's massive consequences would extend beyond Nevada, affecting sports betting liquidity and tourism spending nationwide.