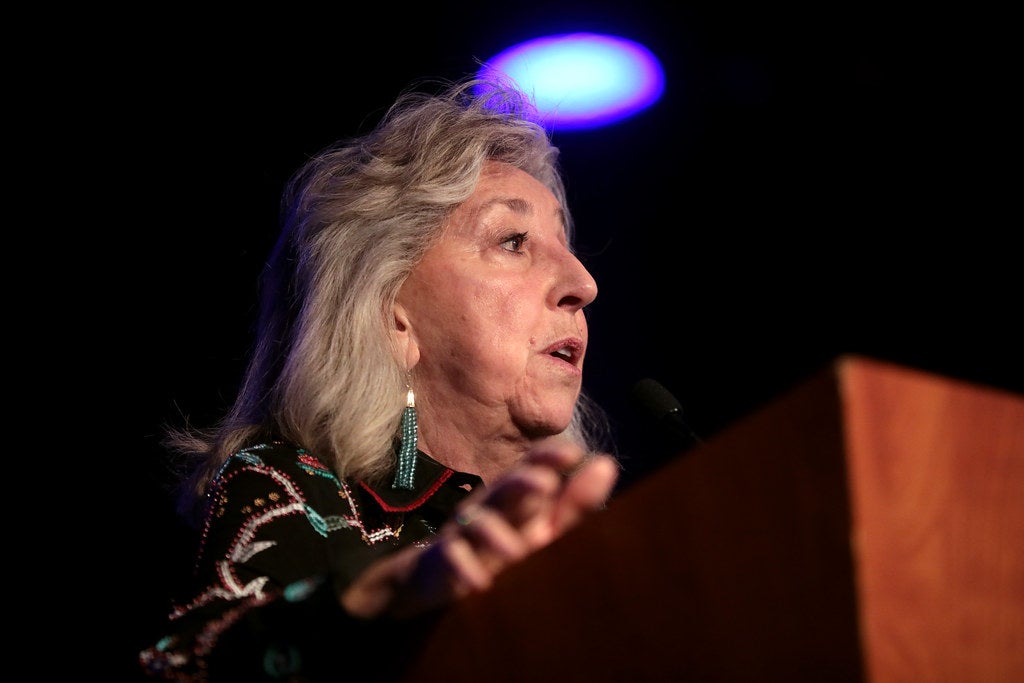

Nevada Rep. Dina Titus Provides Comment

In conjunction with introducing the FAIR BET Act, Titus had this to say:

“The recently passed budget bill included a provision inserted by Senate Republicans without consent of the House that imposed a tax increase on Americans who gamble by reducing from 100 percent to 90 percent the amount of losses they can deduct from gambling winnings for their income taxes,” Congresswoman Titus said. “My FAIR BET Act would rightfully restore the full deduction for losses so gamblers don’t pay taxes on money they haven’t won.

“This common-sense legislation will bring fairness back to gaming taxation, making sure that gamblers can fully deduct losses when they report their winnings. It gives everyone –from recreational gamblers to high-stakes gamblers -- a fair shake. We should be encouraging players to properly report their winnings and wager using legal operators. The Senate change will only push people to not report their winnings and to use unregulated platforms.”

Key Association Backs the Bill

Since Titus introduced the bill, the American Gaming Association, an organization that lobbies on behalf of the gambling industry, has come out in support of it.

"The American Gaming Association applauds Congresswoman Titus for introducing the FAIR BET Act," the organization told ESPN. "We are committed to working with Congresswoman Titus, other congressional leaders, and the Trump Administration to restore the long-standing tax treatment of gaming losses."

This may seem contradictory to the association's commendation of the One Big Beautiful Bill Act, but there's a key passage in there.

The statement regarding the One Big Beautiful Bill began with:

“We commend congressional leaders on the passage of the One Big Beautiful Bill Act. Our industry’s ability to sustain quality jobs and deliver economic benefits is significantly enhanced by the tax policies of the OBBBA that support consumers, encourage business innovation and investment, and strengthen competitiveness.”

However, the AGA did go on to mention the tax code, and it sounded like they'd be eventually pushing for a change.

“We look forward to President Trump’s expected signing and will work closely with Congress in the coming months to address the changes to wagering deduction losses and further modernize the tax code.”

Now, with Titus's bill, the AGA aims to achieve everything it wants, including the positive aspects for the gambling industry in the One Big Beautiful Bill, as well as reversing the tax to 100% deductions for gamblers with Titus's legislation, assuming it passes.