When participating in gambling activities of any kind, how you manage your bankroll is essential for long-term success and enjoyment. This is where money management comes in. In roulette, as with any other casino game, money management is simply a strategy for budgeting and stretching your money further.

Understanding the ins and outs of money management will ensure that you can improve your budgeting not only at the roulette table but also in everyday life. With that in mind, we thought we’d gather some of the sharpest minds in the world of casino gaming to share their expert budgeting tips with you so that you can find out exactly how to get more bang for your buck. Welcome to the official Casino.com guide to money management.

What is Money Management?

Before diving into the world of casino gaming, let’s take a step back so that we can discuss money management more generally. Put simply, money management is an umbrella term that describes any strategy for saving, budgeting, investing, and spending your own cash.

It is a term that describes the various strategies people use to extend their capital and shore up financial security in the short and long term.

You’ll frequently hear the term come up in a financial industry complex, where wealth managers and stockbrokers use it to describe the ways in which they enhance or shore up the wealth of organisations or clients. However, the term is also frequently used in casino gaming, often with the same principles in mind.

The Importance of Money Management when Playing Roulette

When playing roulette, how you manage your money and approach your bets is absolutely essential to your success. After all, roulette is a game of pure luck. There is no amount of skill and no tricks that can be used to affect the outcome of a spin of the roulette wheel, as the number it lands on is based entirely on Lady Luck. One area you do have full control over at the roulette table is your bankroll, which is the cash that you have earmarked specifically for casino gaming. By understanding the ins and outs of money management, you can ensure that you not only have a larger bankroll to play with but that you spend your bankroll more wisely to get as much out of the game of roulette as possible.

Money Management Methods

No matter the reason for wanting to make your money go further, a strategy can make the world of difference. Fortunately, there is a wealth of effective, tried-and-tested money management methods out there, many of which have been concocted by some of the most prudent financial minds to have ever lived.

As we will see in the chapter, all of the popular money management methods that will help you budget better can also be applied at the roulette table, so that you can enjoy more of your favourite casino game for less.

Much of the most effective money management strategy is all about making the correct psychological adjustments and changing how you view your money so that you can earmark and spend it more carefully. Read on to find out some of the most successful and popular money management methods to try.

The Envelope Method

Oftentimes, the most effective money management comes from your ability to set strict limits on yourself and your bankroll. In a general sense, the envelope method is an exercise in delegation and restraint. It works like this: first, figure out all of the ‘categories’ of spending that you go through in a typical month (i.e. food, rent, utilities, dining, travel).

Then, determine how much you are willing to spend on each. After this, label an envelope with each category and set aside the predetermined amount for each category in each envelope. This idea is that this is the absolute total of cash you are allowed to spend on each category in a month.

You cannot go over, as there would be no money left in the envelope with which you could do so. In the digital world, you can use apps and e-wallets to divide up your budget, instead of taking cash out.

Zero-sum budgeting method

Put simply, a zero-sum budget is one that ensures every single penny you earn or save is put to use, rather than just sitting there idly or being wasted. It works like this: you need to first take stock of all of your earnings to get an exact figure of how much money you have coming in.

Then, you ‘allocate’ every single penny to a different activity. You could dedicate X amount to necessity spending, X amount to entertainment (or X amount to roulette), X amount to investing, and X amount to emergency saving. The point is that every single penny is ‘spent’ on something productive, ensuring that you are putting your money to work for you.

The 50/30/20 Budget

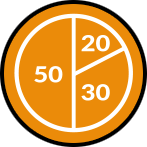

The 50/30/20 rule is an all-time classic of money management, one that was first popularized by none other than Senator Elizabeth Warren. There are several variations of this popular financial mantra, but its most basic form goes like this: first, you take all of your after-tax income and divide it into three parts.

50% should be dedicated to your ‘needs’ (such as rent and utilities), 30% should be dedicated to your ‘wants’ (such as recreation and entertainment), and the remaining 20% should be allocated towards savings and investments.

The central tenet here is that you can save towards a secure financial future without having to live a spartan lifestyle. According to Warren, doing this throughout your life should be more than sufficient for a comfortable retirement.

The 60% Solution

The 60% solution, first pioneered by MSN Money’s editor-in-chief Richard Jenkins, is a more ambitious version of the 50/30/20 system. With this one, the goal is to earmark 60% of all of your total income and earnings towards expenditures. What is meant here are all expenditures of any kind, whether it’s a round of online roulette or your monthly bus pass.

The remaining 40% of your income should be saved and not touched at all. Clearly, sticking to this would see your savings quickly skyrocket, even on a modest income. Of course, this is one solution that often asks its adherents to make significant lifestyle changes to achieve it.

The No-budget Budget

In a world where financial guidance is abundant, budgeting can be seen as something of a dirty word. That’s why many people are now adopting the so-called ‘no-budget budget’. With this, you only need to calculate your total necessary expenditures and your total income. From here, you set up a direct debit to ensure that all of your necessary expenditures are automatically paid as soon as you get your paycheck.

Then, you should set up a direct debit that automatically sends at least 10% of your income (although some people advocate a higher amount) to a savings account that you cannot access. The remaining amount is yours to spend or save how you please. However, once this money is gone, it’s gone. The goal of this budget is to ensure that you never unnecessarily fall into debt.

Values-based Budget

Usually, we budget based on the priorities of someone else, rather than on our own desires. This is why a values-based budgeting system has arisen to address this. With values-based budgeting, your money is allocated across three categories: the basics, your values, and the expendables.

The goal is to cover the basics and ensure that all of your spending and saving goes towards things that align with your values while discouraging ephemeral spending. As a result, you will be able to unlock meaningful spending habits and ensure that you are living in a way that aligns with who you are and what you believe in.

What Type of Budgeting Technique is Best for Me?

Of course, each of these money management methods is best suited to different types of people. For example, those with a higher amount of disposable income and very few financial constraints might be better suited to the no-budget budget, since this is designed for people who are earning more than enough to cover all of their bills.

Meanwhile, a person who is serious about preparing for an early or comfortable retirement might opt for the 50/30/20 system, while someone who is older and has less time to save for retirement should kick things up by choosing the 60% solution. The goal is to identify your financial constraints and where you have some wiggle room to create a genuinely sustainable money management system.

Top Money Management Tips from Experts

One place where savvy money management skills come in handy is the casino, particularly at the roulette table. With that in mind, we spoke to some casino gaming experts to hear their thoughts on the essential budgeting skills that you should bring to the roulette table, to get the absolute most out of your game.

“Budget for how much you’re willing to lose, not how much you want to win”

Heather Ferris, CEO and founder of Vegas-Aces.com

When you go to the casino, the first thing you want to figure out is how much you’re willing to lose before you get up and leave. What’s the most money you want to spend for a night of entertainment? How much can you afford to lose? When you’re doing your budget, do it with expected losses. Don’t ever do wins because expecting wins is like kicking Lady Luck and then expecting her to pay you. It’s not going to happen.

Set yourself limits for each game. For example, tell yourself, ‘I’ll play $50 on blackjack, once that $50 is gone I’m going to roulette. I’ll spend $50 on roulette, once that’s gone, that’s $100, that’s my budget for the day.’ That way, you spend what you can afford, you have fun, you’re entertained, and you go home.

“Set a bet limit for each spin”

Stephen Tabone, author and betting strategist

Decide what percentage of your bankroll you’re going to bet with on each spin. Stick to that limit even when you go on winning or losing streaks and avoid the temptation to go all in with a single bet.

Betting consistent amounts on each spin is the best way of making your bankroll last. You will take advantage of any winning streaks and limit losses when losing streaks occur. A good number is 5%, as then you know you’ll be able to bet on at least 20 spins of the wheel.

“Learn the game before you play”

Angela Wyman, YouTube host and former casino dealer

If you’re new to casino gaming, make sure you learn the rules of the game before you start playing. That way you’ll avoid any surprises when you put your money on the table. Think about it this way: would you gamble your money in any other way if you didn’t know how you win or lose?

For roulette, learn the difference between inside and outside bets. Learn the payouts for each type of bet. If you’re playing in a land-based casino, the dealer is there to help, so ask them if you’re in doubt. If you’re playing online, look for the casino’s help pages, as they will tell you everything you need to know. Once you’ve got a good grasp of the rules, you’ll find it much easier to plan your budget.

“Always know the house edge”

Heather Ferris, CEO and founder of Vegas-Aces.com

Always remember that casinos will come out ahead in the long run, and this is due to the house edge. The house edge is the amount of money that the casino is expected to make off each spin of the roulette wheel and it’s typically expressed as a percentage.

The house edge differs depending on which roulette variant you play. For example, the house edge on a double-zero roulette table is 5.26%. That means if you bet $100 per spin, you would be expected to lose $5.26 of that. At 60 spins per hour, that adds up to $315.

Over time, this can up to some serious money, so if you’re playing for three or four hours that’s around $1,000. The best thing you can do is pay attention to the house edge and look for a game that is as close to zero as possible. Knowing the house edge can help you plan your budget and give you an approximate idea of how long your money will last.

“Don’t be an emotional gambler”

Steve Bourie, author of the bestselling American Casino Guide Book

This is often easier said than done but try to avoid letting your emotions dictate how you play – your bankroll will thank you for it. It’s natural to feel happy when you win and disappointed when you lose, but if you let those emotional responses override the planning and strategy behind your play, you may find yourself placing bets you ordinarily wouldn’t.

The solution to that is to just take a step back from the game. If you lose a few spins on roulette and start to get frustrated, move away from the table. Go for a walk and forget about those last spins. Then, with a clear head, think about what you want to do next.

The same advice applies when you go on a winning streak. After a few winning spins at the roulette table, it may be tempting to ride your luck and place bigger bets than you usually would. That is also emotional gambling. In that scenario, you should also take a break, appreciate the fact that you’re up, and reset.

Did you know?

Senator Elizabeth Warren first wrote about the 50/30/20 method in a book she co-authored with her daughter Amelia Warren Tyagi, called All Your Worth: The Ultimate Lifetime Money Plan. The simplicity and versatility of the method has since led it to become a staple of financial management.

Previous: Roulette Tips