Macau Probes Fake US$3.6 Million VIP Investment Scam by Hong Kong Pair

Photo by Wikimedia Commons, CC BY 3.0

Key Takeaways

- Forged documents and staged venue tours were used as deception tactics

- Suspects were arrested at the Border Gate, with HK$222,000 cash seized

- The pair is charged with aggravated fraud and document forgery offenses

Macau authorities have arrested two Hong Kong residents, 69-year-old Luo and 48-year-old Yang, for allegedly orchestrating a HK$28 million (US$3.6 million) investment scam involving a fake casino VIP lounge.

Police claim the duo forged contracts, conducted fabricated venue tours, and guaranteed monthly returns to convince a foreign investor of the NAPE district project’s legitimacy.

The suspects reportedly cultivated trust through multiple Macau meetings before launching the scheme, which collapsed when payments ceased in early 2025.

Fraudulent Investment Scheme Details

Authorities revealed the Hong Kong-based suspects allegedly presented their company as having secured a casino VIP lounge management contract, promising 3% monthly returns through phased investments. Judicial Police spokesperson Leng Kam Long stated the pair “repeatedly urged the victim to invest in a VIP room at a NAPE-area casino,” per local reports.

Investigators disclosed forged documents bearing counterfeit casino logos, corporate seals, and signatures were used to validate the phantom operation. The scheme included orchestrated tours of a gaming venue where staff allegedly explained non-existent VIP room operations to the investor.

Court documents indicate the foreign national, introduced through an acquaintance in 2023, initially hesitated before being swayed by fabricated contracts and guarantees of casino-linked income streams. Police emphasize that these tactics were designed to simulate operational legitimacy prior to the 2025 payment default.

Funds Transfer Timeline

Between November 2023 and April 2024, the investor transferred funds totaling CNY8.4 million and HK$19 million (about US$3.59 million combined) through multiple transactions. Initial “profits” of HK$4 million were disbursed to maintain credibility before payments ceased abruptly in April 2024.

Authorities allege the suspects ignored refund demands, leaving a net loss of HK$24 million. After seven months of unfulfilled promises, the investor formally reported the fraud to the Macau police in November 2025.

Fraudulent Scheme Unravels at Border

Macau investigators confirmed the casino cited in the suspects’ paperwork denied any partnership with their Hong Kong-based company, verifying no VIP lounge contract existed. Forensic examination revealed mismatched fonts, irregular signatures, and non-standard formatting in the presented documents, proving forgery. Judicial Police emphasized the entity had never conducted legitimate business operations.

Authorities apprehended Luo and Yang during a re-entry attempt through the Border Gate on January 12, seizing three counterfeit company seals, two smartphones, and HK$222,000 in cash. Investigators concluded the initial HK$4 million “returns” were likely part of the victim’s own transferred funds rather than genuine profits.

Lucas Michael Dunn is a prolific iGaming content writer with 8+ years of experience dissecting it all, from game and casino reviews to industry news, blogs, and guides. A psychology graduate and painter that transitioned into the iGaming world, his articles depend on proven data and tested insights to educate readers on the best gambling approaches. Beyond iGaming content craftsmanship, Lucas is an avid advocate for responsible play, focusing on empowering players to strike a balance between thrill and informed choices.

Related News

SkyCity Faces Legal Test Over Malta-based Online Casino

SkyCity says it will defend proceedings over losses on SkyCity Online, as a funded class action looks set to test whether the Malta-based model was lawful for NZ players.

PointsBet Canada Seeks Appeal Against AGCO Five-Day Suspension

PointsBet Canada is appealing a five-day suspension from the AGCO over failures to report suspicious betting activity tied to NBA star Jontay Porter.

SA Provinces Told to Enforce Ban on Online Casinos as NGB Tightens Compliance

The National Gambling Board has issued a compliance notice to provincial regulators, targeting remote gambling servers and tightening enforcement.

New Zealand DIA Seeks Feedback on Updated Pokies Machine Standards for Casinos and Class 4 Venues

New Zealand’s DIA is consulting on changes to minimum standards for casino and Class 4 pokies equipment, including ANZ GMNS revision 12.1.

Thailand Police Raid Underground Poker Ring in Phuket Villa

Phuket authorities uncovered the illegal poker operation through social media surveillance, leading to the arrest of nine foreign nationals.

ACMA Flags BetStop Breaches by Six Bookies as Enforcement Ramps Up

Six wagering brands let self-excluded customers access betting or receive marketing, prompting a Tabcorp penalty plus audits, directions and warnings.

New Zealand Online Casino Bill: What New Ad and Harm Minimisation Rules Could Mean

A government impact statement signals how New Zealand could control online casino advertising, harm tools and player protections once licensing begins.

B.C. Supreme Court Upholds Casino Cash Restrictions Against Resident

The Cullen Commission revealed organized crime links to money laundering in casinos, reinforcing the cash regulations upheld in the Ghotaymi ruling.

Tsogo Sun Approved to Relocate Caledon Casino Licence to Somerset West

A decade-long plan to move a Western Cape casino licence has been approved, setting up Tsogo Sun’s next big land-based project near Cape Town.

.jpg)

Toronto Police Corruption Case Links Multiple Officers to Organized Crime

York Regional Police's "Project South" has uncovered links between Toronto officers and organized crime, exposing extortion and illegal gambling.

Illegal Crypto Casino Promos on Instagram put Influencers on Notice

Australian regulators say Instagram promos for offshore crypto casinos can breach gambling laws. Here’s how to spot the risks before you click.

Thai Military Exposes Scam Operations at Cambodia Border

Thai forces uncovered a transnational cybercrime scam network near the Thai-Cambodia border, pledging to secure the area through bilateral talks.

China Executes 11 Criminals Linked to Myanmar Organized Crime Syndicate

A Wenzhou court sentenced the individuals for homicide, fraud, and running gambling dens linked to Myanmar gangs, resulting in 14 deaths.

Taiwan Charges 35 in NT$30.6B Online Gambling and Laundering Case

Authorities report the gambling ring moved NT$30.6 billion in illicit funds using custom payment platforms to hide transactions to illegal sites.

DIA Updates New Zealand Online Casino Licensing Guidance

The DIA has refreshed its provider guidance and reiterated key 2026 milestones in the Online Casino Gambling Bill, including when operators who haven’t applied for a licence must exit New Zealand.

Gambling Commission sets out enforcement and priorities in annual report

The Gambling Commission’s 2024–25 annual report details a year of enforcement activity, regulatory reform and operational change as the regulator prepares for the next phase of gambling oversight.

European Court Decision Empowers Players to Claim Losses from Offshore Sites

The EU Court of Justice affirms players may sue directors of unlicensed foreign gambling operators under their home country’s laws.

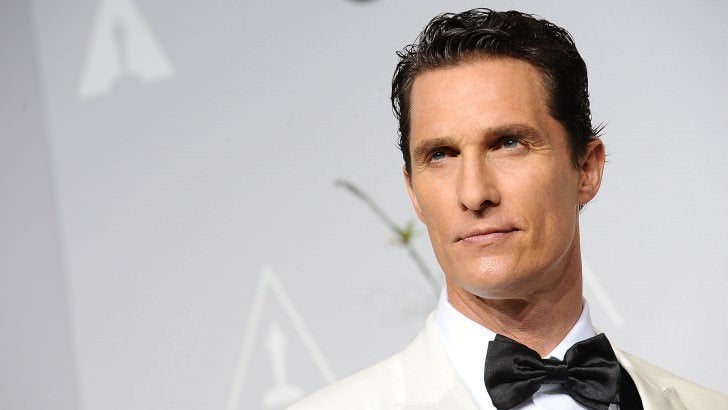

Matthew McConaughey Fighting Against AI Misuse By Trademarking Himself

With an uptick in likeness being used by AI, Matthew McConaughey is fighting against it by trademarking himself.

AGCO Slaps FanDuel Canada with $350K Penalty for Suspicious Table Tennis Wagers

AGCO reports FanDuel Canada accepted 144 bets from three Ontario player accounts during October-November 2024 on matches with multiple red flags.

German gambling market enters 2026 facing key court rulings and regulatory tests

Germany’s regulated gambling market moves into 2026 with major legal rulings and regulatory decisions expected to shape its future direction.

Shares drop at Mecca Bingo owner rank after £6.2m payment fraud

Rank Group shares fell after the company confirmed a £6.2m payment fraud affecting its Spanish operations and launched an investigation.

Illinois Sweeps Casino Update: Evolution Gone? Sweeps Casino Leaving?

Sweeps Casino Tora Tora is leaving on Jan. 10, and game provider Evolution has left the state, too.

Indiana To Hold First Anti-Sweeps Casino Bill Hearing on January 6

Indiana is holding a hearing on its sweepstakes casino ban bill on Jan. 6.

NZ Online Casino Licensing Reform: What the Online Casino Bill Changes

NZ Parliament is progressing the Online Casino Gambling Bill. We break down what’s in it, what’s next, and what it could mean for NZ players.

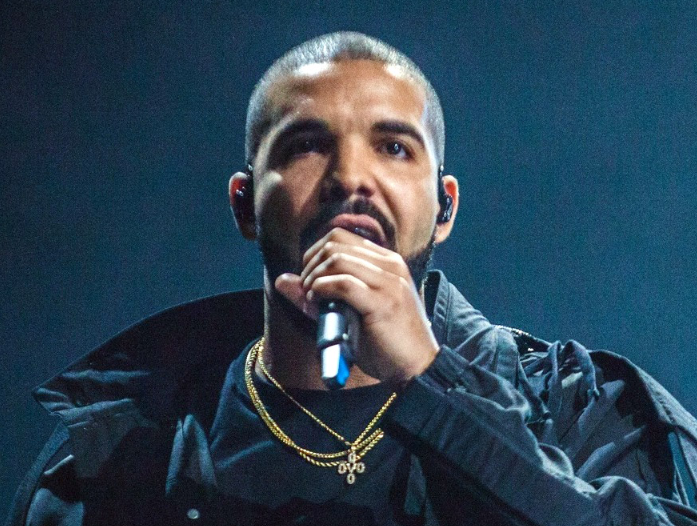

Drake, Adin Ross Named in Music Botting Lawsuit Involving Stake

Drake and Adin Ross were “zealous promoters” of Stake.com and Stake.us, the American sweepstakes casino version of the crypto-based platform.

Maine's Bill That Would Ban Sweepstakes Casinos Has Hearing Scheduled

The anti-sweepstakes casinos legislation in Maine is on the move as a hearing is set for January 14.

Reporting Deadline Set For Massachusetts Sweepstakes Casino Ban Bill

The reporting deadline for Massachusetts' sweeps ban bill has been extended to March 16, 2026.

Modo.us to Launch New Rewards Program, "Modo Stars," On CA Ban Day

California's sweepstakes casino ban goes into effect on Jan. 1, 2026, the same day Modo.us is launching a new rewards program.

Virtual Gaming Worlds Provides Official Comment on California Plans

Amid speculation of the final date in which Sweeps Coins could be used in California, VGW has released a statement.

WOW Vegas to Allow Sweeps Play Up Until 1 Minute Before California Ban

WOW Vegas will allow players in California to use their Sweeps Coins in their account up until 11:59 pm PT on Dec. 31, 2025.

Sweeps Play Plans for Virtual Gaming Worlds in California Revealed?

Brian Christopher, also known as BCSlots, made a Facebook post that may signal VGW's sweepstakes play plans in California.

Top Gaming Research Outlet Has Doubts About MA's Sweeps Ban Bill

Eilers & Krejcik has doubts that Massachusetts House Bill 4431, which would ban sweeps casinos, will pass.

Michigan Man Killed Mother, Stole Money and Jewelry to Gamble At Casino

A press release from the police said that the brother claimed the victim, who had allowed James Hall to move in less than one year before, was afraid of him.