Mixed Economic Signals

Nevada’s labor market maintains relative stability despite turbulence in major sectors, according to DETR chief economist David Shmidt’s January 6 assessment, which described conditions as “fairly steady.”

On the other hand, construction and finance/insurance, which endured the most employment declines, simultaneously recorded the state’s sharpest wage growth. Schmidt characterized this divergence as contributing to a “mixed picture” for Q4 2025.

Leisure and hospitality, while remaining Vegas’ largest employment sector, proved vulnerable to fluctuating tourism demand. Losses were primarily in hotel, food, and entertainment services, per DETR metrics.

Construction Decline

Las Vegas’s construction sector contracted sharply in late 2025 as major resort and infrastructure projects reached completion, ending a multiyear expansion cycle that had sustained hiring. Concurrently, the Las Vegas Convention and Visitors Authority confirmed visitor declines undermined mid-week occupancy and convention attendance, two pillars of the city’s revenue stability.

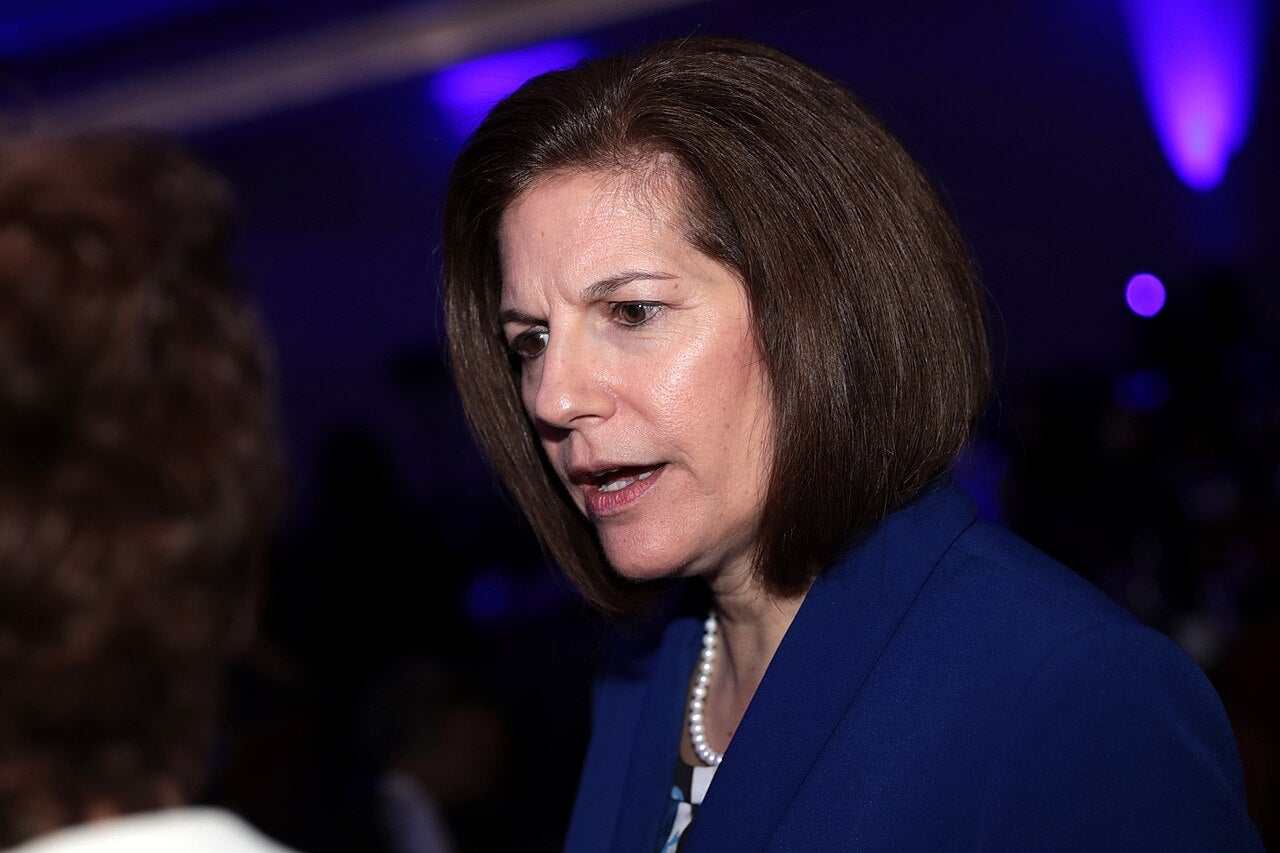

Nevada Senator Jacky Rosen told The Washington Post, “Less tourism means less shifts at the job, less small businesses that support our tourism industry. It’s going to cause businesses to go under. It has a trickle-down effect.”

Deepening Visitor Crisis

Las Vegas recorded 35.5 million visitors through November 2025, a 7.2% year-on-year drop, representing 2.8 million fewer arrivals than in 2024, according to LVCVA data. This erosion of the city’s economic cornerstone contributed to weakened business confidence levels not seen since the Great Recession, which UNLV researchers attribute to weak tourism and broader economic uncertainty.

The labor market reflected mounting strain, with Nevada’s November unemployment reaching 5.2%, according to the DETR, ranking third nationally behind California (5.6%) and Washington, D.C. (6.2%).

.jpg)