Las Vegas Visitor Trends and Economic Outlook

Reeg pointed out that the 7.5% decline in visitation to Las Vegas in 2025 is part of a “normal economic cycle activity in leisure.” He highlighted a notable drop in drive-in traffic from California and a decrease in visitors from Canada. In the last quarter of 2025, Las Vegas recorded an occupancy rate of 92%, down from 96.5% the previous year, while the average daily room rate fell by 9%.

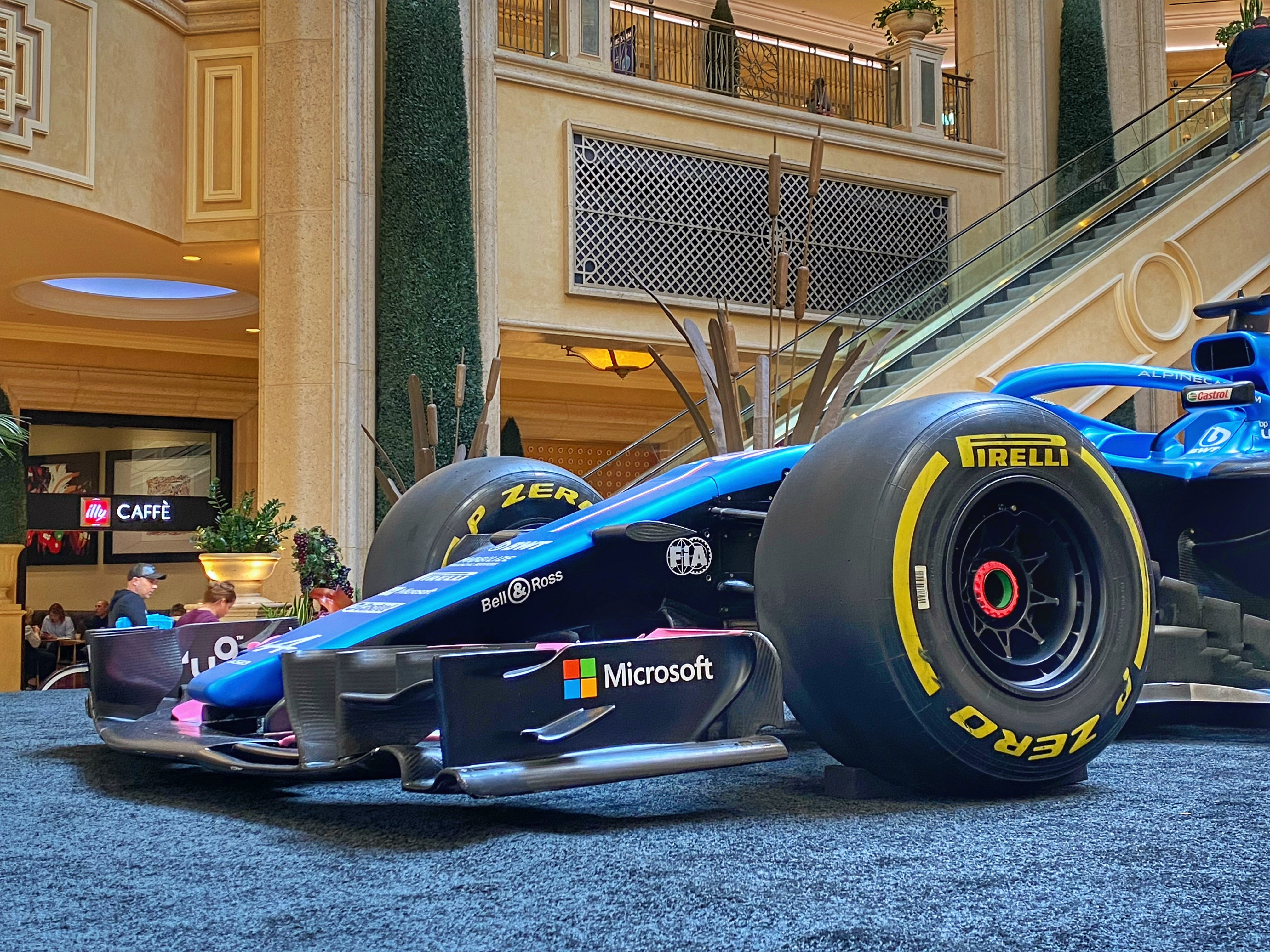

Despite these challenges, Reeg emphasized the success of major events like the Formula 1 race and the Super Bowl, which contributed to a robust occupancy rate during the quarter.

Caesars Entertainment Q4 Financial Performance

Caesars Entertainment reported mixed financial results, with Q4 revenue reaching $2.92 billion, aligning with analyst expectations. However, earnings per share (EPS) fell from -0.27 to -0.33, raising concerns about profitability. The company’s total revenue for 2025 was $11.5 billion, slightly surpassing the previous year’s figures.

Despite a profit of 0.05 cents per share in Q4 2024, the company has faced two years of losses, compounded by a significant debt load of $24.8 billion. The digital segment continued to perform well, achieving record revenue of $410 million, while the Las Vegas segment saw some margin declines.

Future Outlook for Las Vegas Operations

Looking ahead, Reeg discussed the ongoing challenges posed by fluctuating occupancy rates and seasonal demand. He highlighted that while peak events and weekends are performing well, shoulder periods remain challenging. President and COO Anthony Carano noted that net revenues rose 4% company-wide, with adjusted earnings increased 2%.

Regional properties, although impacted by weather, are expected to improve in 2026 due to strong group bookings and renovations. Reeg also addressed the uncertain future of prediction markets and their potential effects on the company’s sports betting operations. He maintained that Caesars would not risk its licenses in pursuit of this avenue.

.jpg)