BCLC Concerns Over Casino Cash Transactions

Records from the BCLC reveal that Ali Ghotaymi completed 29 significant cash transactions at various Canadian casinos between February 2019 and July 2021.

11 of those transactions totaled $9,000 each. Notably, on February 17, 2020, he made two separate $9,000 buy-ins at different casinos within two hours.

Ghotaymi, an employee of Canada Post, expressed frustration at being labeled a potential money launderer, claiming it hindered his job prospects and his security clearance. He argued that the lack of prior notice regarding his restrictions was unjust. He asserts that his cash came from previous casino winnings. However, BCLC maintains that sourced cash conditions are essential for large buy-ins. The term requires patrons to establish a traceable transaction history.

Origins of the Casino Restricted List

The implementation of the restricted list arose from a significant money laundering crisis within British Columbia’s casinos. A 2022 report by the Cullen Commission highlighted the severity of the issue, revealing that in 2014 alone, B.C. casinos processed nearly $1.2 billion in cash transactions exceeding $10,000. This included 1,881 buy-ins of $100,000 or more, averaging over 5 per day. The findings indicated a direct connection between organized crime and money laundering activities in these establishments.

Planned Regulatory Changes

The Cullen Commission criticized the BCLC for insufficient response to money laundering issues. In response, the B.C. government enacted a new Gaming Control Act, set to take effect this April. The draft aims to implement recommendations from the 2018 Dirty Money report and the Cullen Commission.

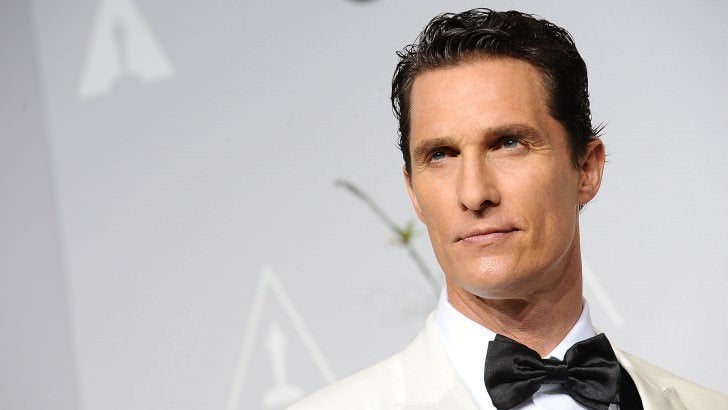

This legislation will establish an independent gambling regulator, as noted by B.C.’s Public Safety and Solicitor General. In the context of the Ghotaymi case, Supreme Court Justice Matthew Kirchner emphasized that BCLC’s actions are administrative. He argues the decision regulates Ghotaymi’s buying methods without formally accusing him of involvement in money laundering or imposing penalties.

.jpg)