A Last-Minute Addition

House Republicans are intensifying efforts to reshape perceptions of their sweeping tax legislation, which faces criticism for potentially stripping Medicaid access from millions while extending corporate tax breaks. Jason Smith singled out Senate colleagues for inserting the last-minute provision reducing gambling loss deductions, sparking backlash from both recreational gamblers and casino operators.

Casino Operators Raised Alarm

Following a marathon field hearing in Las Vegas, Smith revealed private discussions with MGM Resorts CEO Bill Hornbuckle and other gaming executives, whose companies span multiple states. “They praised numerous provisions in the tax code, and they only raised one that they had issues with,” Smith noted, referencing pressure from Missouri-based casinos in his district.

The chairman pledged bipartisan collaboration to restore loss deductions to 100%, emphasizing the reversal as urgent despite the bill’s impending implementation.

More Push for Bipartisan Fix

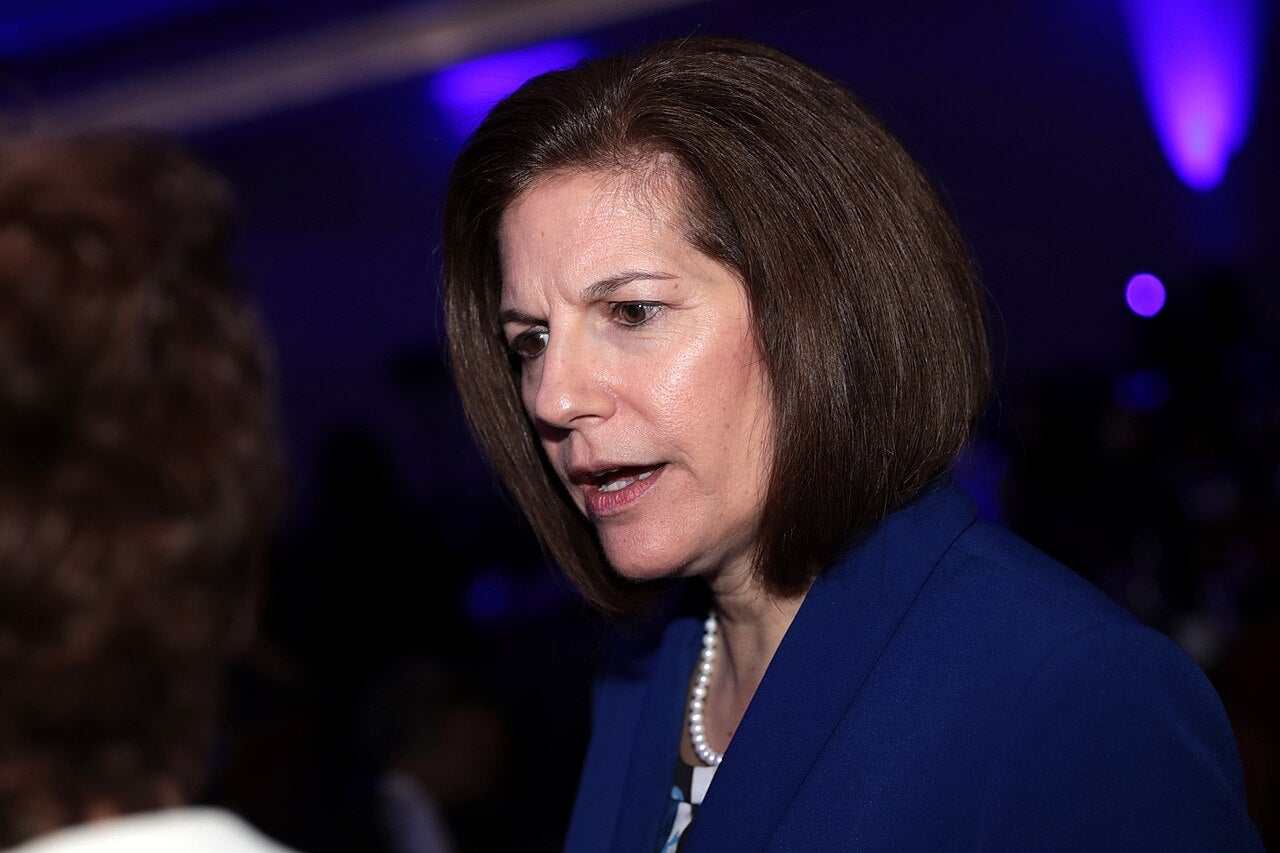

Rep. Dina Titus (D-NV) introduced the FAIR BET Act to restore full gambling loss deductions, attracting 10 House cosponsors from both parties. Though not a Ways and Means Committee member, she joined its Las Vegas field hearing held in her district at YESCO Sign Company.

Titus welcomed Chair Smith’s pledge to reverse the tax provision, stating, “I was very glad to hear the chairman say he will work with us to undo that reduction.” She acknowledged the Senate’s role in inserting the clause. Still, she stressed that House Republicans took accountability for passing the bill: “The Senate did put it in there, but it came back to the House, which wouldn’t accept any amendments, and Republicans voted for it. So, let’s be sure we know who’s responsible, and let’s work together to fix it.”