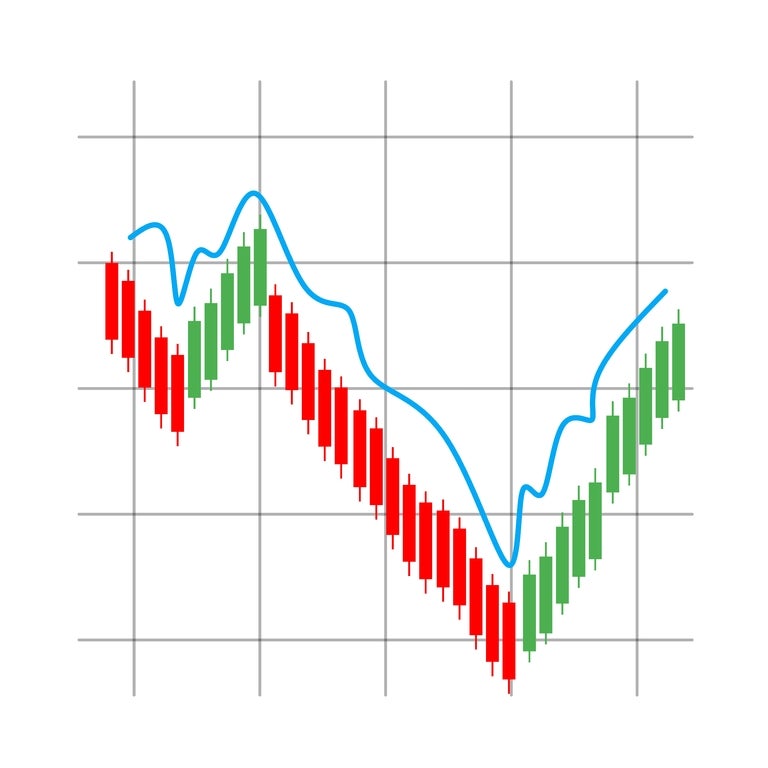

Shares in Playtech plc (LSE: PTEC) have continued to hold above their 50-day moving average. This is in the midst of a choppy start to the year for the wider market. The stock has recovered from its early January lows and is now trading in a relatively narrow range. This suggests some stabilisation after recent selling pressure. While Playtech remains down over the past 30 days, we note that holding above this key technical level can often signal a shift in short-term sentiment, even if broader uncertainty remains.

Playtech shares hold above 50-day moving average as selling pressure eases

Playtech share price chart showing recent stabilisation above the 50-day moving average. PXhere, CC0

Key Takeaways

- Playtech shares remain above the 50-day moving average

- Recent price action suggests selling pressure may be easing

- Analysts remain divided on the stock’s near-term direction

Playtech holds key technical level after volatile start to January

Playtech shares are currently trading around the mid-270p range, remaining above the 50-day moving average near the low-270s. Earlier in the month, the stock dipped sharply before rebounding, forming what appears to be a short-term base. We see this as a sign that aggressive selling may be easing, even if upward momentum is still limited.

Recent price action points to stabilisation rather than breakout

Over the past month, Playtech shares are down just over 3%. This reflects broader market volatility rather than being specific to Playtech. Importantly, the stock has avoided further breakdowns below recent support levels. From our perspective, this looks less like a bullish breakout and more like consolidation, with investors reassessing value after recent declines.

Analysts remain mixed as investors watch next move

Analyst sentiment around Playtech remains divided. Previous updates have seen a mix of hold and buy ratings. We’ve seen a wide range of price targets reflecting uncertainty over near-term performance. For now, attention is likely to stay on technical indicators and broader market conditions. If the shares continue to hold above the 50-day average, we expect confidence to remain steady, rather than decisively positive.

Broader market conditions continue to shape Playtech’s outlook

If we look beyond technical indicators, wider market conditions are still playing a significant role in how Playtech shares are trading. UK-listed stocks have faced a cautious start to the year. Investors are looking at interest rate expectations, macroeconomic uncertainty and sector-specific risks. In that context, stability can be meaningful. We see Playtech’s ability to hold above its 50-day moving average as a reflection of resilience rather than renewed optimism.

The company’s diversified exposure across gambling software, platforms and services continues to underpin its valuation. But near-term performance remains sensitive to shifts in investor risk appetite. Trading volumes suggest steady interest. We don’t think it’s aggressive positioning we’re seeing, which aligns with the stock’s current sideways movement. For many investors, this phase appears to be about reassessment rather than conviction.

Paul Skidmore is a content writer specializing in online casinos and sports betting, currently writing for Casino.com. With 7+ years of experience in the iGaming industry, I create expert content on real money casinos, bonuses, and game guides. My background also includes writing across travel, business, tech, and sports, giving me a broad perspective that helps explain complex topics in a clear and engaging way.

Related News

Macau's February Gaming Revenue Rises 4.5% YoY on CNY Celebrations

In February 2026, Macau welcomed nearly 1.6 million visitors during the Chinese New Year, boosting gross gaming revenue to MOP 20.63 billion.

Ontario's iGaming Breaks Revenue Record, Bragg Reports Growth, Parq Expands

Ontario's iGaming market hit CA$9.52 billion in January wagers, while Bragg Gaming reported revenue growth and Parq Casino advances expansion plans.

SARS Tightens the Net on Crypto Punters from 1 March 2026

From 1 March 2026, SARS will plug crypto and offshore financial data into global exchange systems, making it easier to match trading activity to tax returns — including for bettors using crypto rails.

Petersburg, Virginia Casino Posts Strong First 10-Day Revenue Total

Live! Casino & Hotel Virginia generated close to $4.7 million in adjusted gross revenue during its first week and a half, according to figures from the state.

Macau’s Gaming Activity Slows in Early February Ahead of CNY

Despite the slow start, analysts maintain February revenue forecasts, projecting a 4% increase compared to February 2025.

UK Payments Enter a New Era of Efficiency and Innovation

The UK’s payment overhaul aims to reduce costs for smaller merchants, addressing the significant fees they face compared to larger businesses.

Macau’s Casino Revenue Climbs 24% in January, Signaling Recovery

Macau’s GDP grew 7.6% in Q4 2025, followed by a 24% casino revenue surge in January 2026, driven by tourism gains and stronger domestic demand.

PepsiCo Beats Earnings Estimates as It Prepares to Cut Snack Prices

PepsiCo will decrease prices on several snack items in 2026.

GameStop CEO Teases a “Very Big” Deal That Could Transform Company

GameStop appears poised to attempt to make an acquisition that would be "transformational" to the company, but no target was named.

South Africa Extends Public Comment Deadline on Proposed Online Gambling Tax

National Treasury has pushed back the deadline for public comments on its draft online gambling tax proposals, giving stakeholders until 27 February 2026 to respond.

_for_$2.25_Billion.jpeg)

Clorox to Purchase Gojo Industries (Purell Maker) for $2.25 Billion

Clorox is purchasing Gojo Industries, the company behind Purell, for $2.25 billion.

UK Government Confirms Increased Taxes on Online Gambling Activities

The revised tax framework, targeting remote betting and online casinos, projects to generate over £1 billion annually in tax revenue.

SkyCity Confirms 19 February Results Date as NZICC Opening Nears

SkyCity has set 19 February 2026 for its half-year results release, as the NZICC prepares to open in central Auckland on 11 February 2026.

Netflix Revamps Warner Bros. Discovery Deal With $72B All-Cash Offer

Netflix moved to a $72B all-cash deal for Warner Bros. Discovery, aiming to speed approval and counter a rival bid.

Mixed feelings emerge as gambling tax reforms return to the spotlight

The UK government’s renewed focus on gambling taxation has triggered a divided response across the industry, with operators warning of unintended consequences while policymakers argue reform is overdue.

Following Netflix/Warner Deal, President Donald Trump Purchased Bonds

Following the announcement of the Netflix-Warner deal, President Trump purchased bonds.

Bain Capital To Make Bob's Discount Furniture Public, Files for IPO

The long-time furniture chain, Bob's Discount Furniture, has filed for its initial public offering.

MGM China and Melco Continue Tradition of Discretionary Staff Bonuses

MGM China and Melco award about 96% of employees an extra month’s salary for 2025 work, continuing Macau casino’s annual year-end bonus tradition.

South African Treasury Department Proposes 20% Online Gambling Tax

South Africa’s National Treasury has proposed a new 20% tax on online gambling revenue. We break down the proposal and its potential impact.

Lotte’s Jeju Dream Tower 2025 Casino Sales Jump 62% to US$330 Million

Jeju casino sales surged 62% to KRW476B (US$330M), driven by a 54% visitor spike to 590,000, per unaudited Korea Exchange filings and operator data.

NZ Online Casino Bill 2026: Government Bans Credit Cards as Banks Tighten Gambling Controls

New Zealand banks continue to apply restrictions to gambling-related payments, especially for offshore casinos. We explain what players should know.

Nevada Rep. Titus Pushing for Late-Minute Gambling Tax Changes

Under the 90 percent structure, which will go into effect next year, gamblers could owe money in taxes in net-negative years.

Resorts World NYC Hopes to Lower Tax Commitment for Proposed Casino

...Tax proposals of 56 percent on slot machine revenue and 30 percent on table games, which are well above industry standard.

Norfolk Casino Will Generate Less than 50% of Expected Tax Revenue

The Pamunkey Indian Tribe, which received federal recognition in 2015, was awarded the title of majority owner of the Norfolk project before construction ever began.

Illinois’ Casino Industry Surges 21% YoY During Favorable October

The Illinois Gaming Board revealed in its monthly revenue report that the retail gaming industry generated $165.8 million in October revenue.

Ohio Retail Casino Market Produced $88.9 Million in July, Grows 8.4 Percent YoY

Revenue reached $88.9 million during the period, led by $24.7 million, an 11.3 percent YoY increase, by Hollywood Columbus Casino.

Delaware Casinos Underperform Compared to Figures from July 2024

According to a report published by the Delaware Lottery, the state’s casino market procured $34.8 million in revenue during July.

Macau Posts Best Month Since COVID Outbreak, Hits $2.6 Billion in Revenue

Macau Casinos Post Best Month Since COVID

Atlantic City Casinos Falter Again, New Jersey iGaming Flourishes

Atlantic City Casinos Struggle

Atlantic City Casinos Profitable, But Most Made Less Money than in 2023

Atlantic City Casinos' Bottom Line Drops

Companies Spend Big on Lobbyists Amid Hunt for Three New York Casino Licenses

Casino Groups Spend Big in NY

Macau Casinos To Feel the Effects of Trump’s America First Investment Policy

Trump's Policy to Hurt Macau Casinos?

Eagles’ Success Stalls Pennsylvania Casinos, Overall Gaming Revenue Still Up

Eagles Halt PA's Gambling Progress