Mixed feelings emerge as gambling tax reforms return to the spotlight

Mixed feelings emerge as gambling tax reforms return to the spotlight, Wikimedia Commons, CC 2.0

Key Takeaways

- Gambling tax reform discussions have resurfaced in the UK

- Operators warn of pressure on margins and channelisation

- Policymakers argue changes could modernise the system

Debate around gambling taxation has returned to the agenda. The reaction from the industry has been anything but unified. While some see reform as inevitable, others warn that poorly calibrated changes could do more harm than good.

We’re seeing familiar fault lines reappear. There are concerns around competitiveness, consumer behaviour and regulatory balance all coming back into focus. As discussions continue, the challenge will be to find a framework that reflects modern gambling habits—all without destabilising a market that is already under significant pressure.

Why Gambling Tax Reform Is Back on the Agenda

The current tax framework was designed around a gambling landscape that looks very different from the digital-first market that now exists. Policymakers argue that online gambling growth, combined with shifting player behaviour, has exposed weaknesses in how different products are taxed. From a Treasury perspective, reform is often framed as a way to simplify the system and ensure fairness across verticals.

However, the timing is sensitive. Operators are already adapting to tighter affordability checks and compliance costs. Adding tax uncertainty into the mix risks compounding existing pressures.

Industry Concerns Over Competitiveness and Channelisation

Across the sector, there is clear anxiety about how tax changes could affect competitiveness. Operators warn that higher or restructured taxes may push costs onto players, potentially driving some customers toward unregulated alternatives. Channelisation remains a core concern, particularly in a market that prides itself on strong consumer protections.

We’ve also seen warnings that uneven tax treatment between products could distort innovation, favouring some verticals while discouraging investment in others. For many, stability is just as important as the headline tax rate.

"The government will not proceed with introducing a single tax on remote betting and gaming. Instead, to raise revenue and better reflect the modern nature and impacts of gambling, the following changes will be introduced: The rate of Remote Gaming Duty will be increased from 21% to 40% from 1 April 2026. A new remote betting rate of 25% will be introduced within General Betting Duty from 1 April 2027, remote bets on UK horse-racing will be excluded from these changes and remain subject to a rate of 15% — the new rate does not include bets placed via self-service betting terminals, Pool Betting and Spread Betting. Bingo Duty will be abolished from 1 April 2026." - Policy paper, UK government.

A balancing act for policymakers and regulators

For policymakers, the challenge lies in striking the right balance. There is political pressure to ensure gambling delivers an appropriate return to the public purse. Especially amid wider fiscal constraints. At the same time, regulators and industry voices continue to stress that overreach can undermine long-term objectives.

The current mood is one of caution rather than outright opposition. Most stakeholders accept that reform is possible. Even necessary. What remains contested is how far changes should go and how quickly they should be introduced.

Paul Skidmore is a content writer specializing in online casinos and sports betting, currently writing for Casino.com. With 7+ years of experience in the iGaming industry, I create expert content on real money casinos, bonuses, and game guides. My background also includes writing across travel, business, tech, and sports, giving me a broad perspective that helps explain complex topics in a clear and engaging way.

Related News

New York Casino Groups Dominate Highest Lobbying Spenders in 2025

The total amount spent on lobbying is also before anything is spent on the casino projects themselves, which will cost an estimated $4-8 billion each.

Macau's February Gaming Revenue Rises 4.5% YoY on CNY Celebrations

In February 2026, Macau welcomed nearly 1.6 million visitors during the Chinese New Year, boosting gross gaming revenue to MOP 20.63 billion.

Ontario's iGaming Breaks Revenue Record, Bragg Reports Growth, Parq Expands

Ontario's iGaming market hit CA$9.52 billion in January wagers, while Bragg Gaming reported revenue growth and Parq Casino advances expansion plans.

SARS Tightens the Net on Crypto Punters from 1 March 2026

From 1 March 2026, SARS will plug crypto and offshore financial data into global exchange systems, making it easier to match trading activity to tax returns — including for bettors using crypto rails.

Petersburg, Virginia Casino Posts Strong First 10-Day Revenue Total

Live! Casino & Hotel Virginia generated close to $4.7 million in adjusted gross revenue during its first week and a half, according to figures from the state.

Macau’s Gaming Activity Slows in Early February Ahead of CNY

Despite the slow start, analysts maintain February revenue forecasts, projecting a 4% increase compared to February 2025.

UK Payments Enter a New Era of Efficiency and Innovation

The UK’s payment overhaul aims to reduce costs for smaller merchants, addressing the significant fees they face compared to larger businesses.

Macau’s Casino Revenue Climbs 24% in January, Signaling Recovery

Macau’s GDP grew 7.6% in Q4 2025, followed by a 24% casino revenue surge in January 2026, driven by tourism gains and stronger domestic demand.

PepsiCo Beats Earnings Estimates as It Prepares to Cut Snack Prices

PepsiCo will decrease prices on several snack items in 2026.

GameStop CEO Teases a “Very Big” Deal That Could Transform Company

GameStop appears poised to attempt to make an acquisition that would be "transformational" to the company, but no target was named.

South Africa Extends Public Comment Deadline on Proposed Online Gambling Tax

National Treasury has pushed back the deadline for public comments on its draft online gambling tax proposals, giving stakeholders until 27 February 2026 to respond.

_for_$2.25_Billion.jpeg)

Clorox to Purchase Gojo Industries (Purell Maker) for $2.25 Billion

Clorox is purchasing Gojo Industries, the company behind Purell, for $2.25 billion.

UK Government Confirms Increased Taxes on Online Gambling Activities

The revised tax framework, targeting remote betting and online casinos, projects to generate over £1 billion annually in tax revenue.

SkyCity Confirms 19 February Results Date as NZICC Opening Nears

SkyCity has set 19 February 2026 for its half-year results release, as the NZICC prepares to open in central Auckland on 11 February 2026.

Netflix Revamps Warner Bros. Discovery Deal With $72B All-Cash Offer

Netflix moved to a $72B all-cash deal for Warner Bros. Discovery, aiming to speed approval and counter a rival bid.

Following Netflix/Warner Deal, President Donald Trump Purchased Bonds

Following the announcement of the Netflix-Warner deal, President Trump purchased bonds.

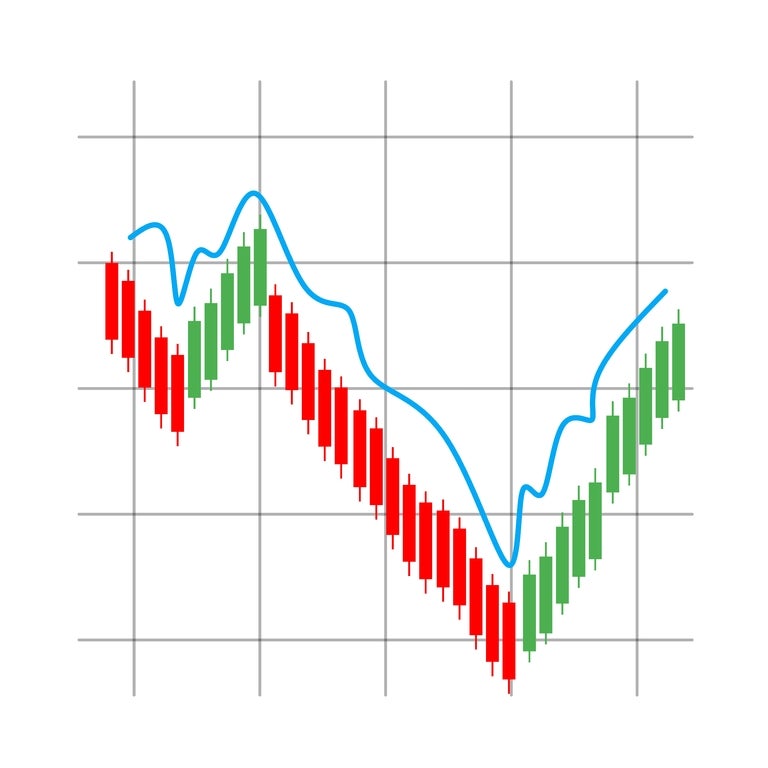

Playtech shares hold above 50-day moving average as selling pressure eases

Playtech shares have continued to trade above their 50-day moving average following a volatile start to the year. While recent price action shows the stock remains down over the past month, holding this technical level may indicate easing selling pressure and a more stable near-term outlook.

Bain Capital To Make Bob's Discount Furniture Public, Files for IPO

The long-time furniture chain, Bob's Discount Furniture, has filed for its initial public offering.

MGM China and Melco Continue Tradition of Discretionary Staff Bonuses

MGM China and Melco award about 96% of employees an extra month’s salary for 2025 work, continuing Macau casino’s annual year-end bonus tradition.

South African Treasury Department Proposes 20% Online Gambling Tax

South Africa’s National Treasury has proposed a new 20% tax on online gambling revenue. We break down the proposal and its potential impact.

Lotte’s Jeju Dream Tower 2025 Casino Sales Jump 62% to US$330 Million

Jeju casino sales surged 62% to KRW476B (US$330M), driven by a 54% visitor spike to 590,000, per unaudited Korea Exchange filings and operator data.

NZ Online Casino Bill 2026: Government Bans Credit Cards as Banks Tighten Gambling Controls

New Zealand banks continue to apply restrictions to gambling-related payments, especially for offshore casinos. We explain what players should know.

Nevada Rep. Titus Pushing for Late-Minute Gambling Tax Changes

Under the 90 percent structure, which will go into effect next year, gamblers could owe money in taxes in net-negative years.

Resorts World NYC Hopes to Lower Tax Commitment for Proposed Casino

...Tax proposals of 56 percent on slot machine revenue and 30 percent on table games, which are well above industry standard.

Norfolk Casino Will Generate Less than 50% of Expected Tax Revenue

The Pamunkey Indian Tribe, which received federal recognition in 2015, was awarded the title of majority owner of the Norfolk project before construction ever began.

Illinois’ Casino Industry Surges 21% YoY During Favorable October

The Illinois Gaming Board revealed in its monthly revenue report that the retail gaming industry generated $165.8 million in October revenue.

Ohio Retail Casino Market Produced $88.9 Million in July, Grows 8.4 Percent YoY

Revenue reached $88.9 million during the period, led by $24.7 million, an 11.3 percent YoY increase, by Hollywood Columbus Casino.

Delaware Casinos Underperform Compared to Figures from July 2024

According to a report published by the Delaware Lottery, the state’s casino market procured $34.8 million in revenue during July.

Macau Posts Best Month Since COVID Outbreak, Hits $2.6 Billion in Revenue

Macau Casinos Post Best Month Since COVID

Atlantic City Casinos Falter Again, New Jersey iGaming Flourishes

Atlantic City Casinos Struggle

Atlantic City Casinos Profitable, But Most Made Less Money than in 2023

Atlantic City Casinos' Bottom Line Drops

Companies Spend Big on Lobbyists Amid Hunt for Three New York Casino Licenses

Casino Groups Spend Big in NY

Macau Casinos To Feel the Effects of Trump’s America First Investment Policy

Trump's Policy to Hurt Macau Casinos?