Fraud linked to Spanish operations

Rank said the fraud relates to its Spanish division. This operates both land-based and online gaming brands, including Enracha and YoBingo.

The company confirmed that the payments were unauthorised and were discovered following internal checks. Local law enforcement has been notified, and an investigation is now underway with the support of an external law firm.

We understand that Rank has not disclosed further details about how the fraud occurred, citing the ongoing nature of the investigation. The company has, however, indicated that steps have already been taken to strengthen internal processes.

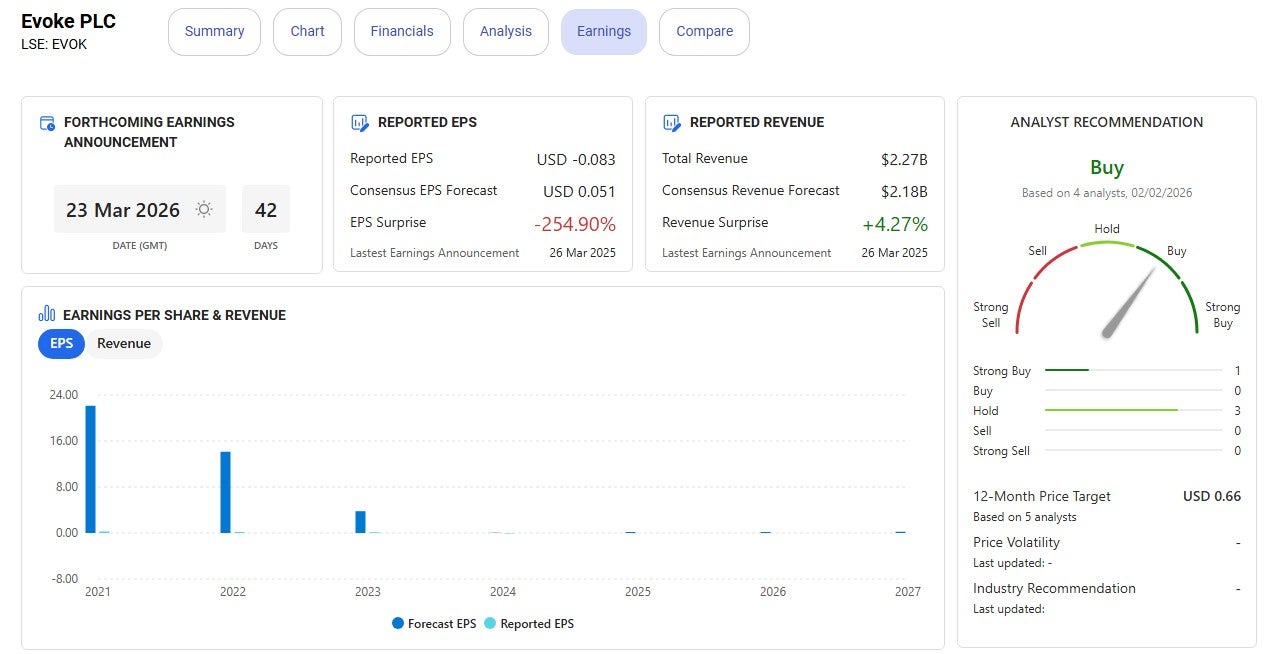

Shares fall as markets react

Rank’s shares fell by around 9% following the announcement. This marks one of the sharpest single-day declines for the group in recent months. The drop reflects investor sensitivity to unexpected losses. This is particularly pertinent where fraud and financial controls are involved.

We note that analysts have highlighted the one-off nature of the incident. Rank has confirmed the loss will not be treated as part of normal trading performance. Even so, the scale of the fraud weighed on market sentiment.

The reaction also comes at a time when gambling stocks remain under pressure more broadly, driven by regulatory change and ongoing cost inflation across the sector.

Financial impact and next steps

Rank said the £6.2m loss will be recorded as an exceptional and separate item in its financial results. The group still plans to publish its scheduled interim results later this month, where further detail is expected.

"The Group has reported the matter to the relevant law enforcement agencies and is supporting their investigations, as well as carrying out its own internal investigation with the help of an external law firm. Given the exceptional nature of this incident, Rank Group expects to treat the financial impact as a Separately Disclosed Item in relation to its 2025/26 performance." - David Williams - Director of Corporate Affairs & Investor Relations

The fraud comes as Rank continues to manage wider challenges. These include higher operating costs and tax changes affecting the UK gambling market. Recent reforms have created opportunities for casino operators. But they have also increased scrutiny around governance and compliance.

From a wider perspective, the case highlights the financial and reputational risks associated with cross-border operations. For investors, attention is likely to remain on how quickly the investigation is resolved and what additional safeguards are introduced.

.jpg)