Tax rise blamed for pressure on retail estate

Evoke has been vocal in its criticism of changes to gambling taxation announced by Chancellor Rachel Reeves in the 2025 Autumn Budget. The company says the increase in online gaming duty and the addition of new levies for remote betting will squeeze margins across its operations.

"We continue to believe these tax increases will negatively impact the industry's economic contribution, customer protection, and will ultimately serve to support further growth in the illegal black market," CEO Per Widerstrom

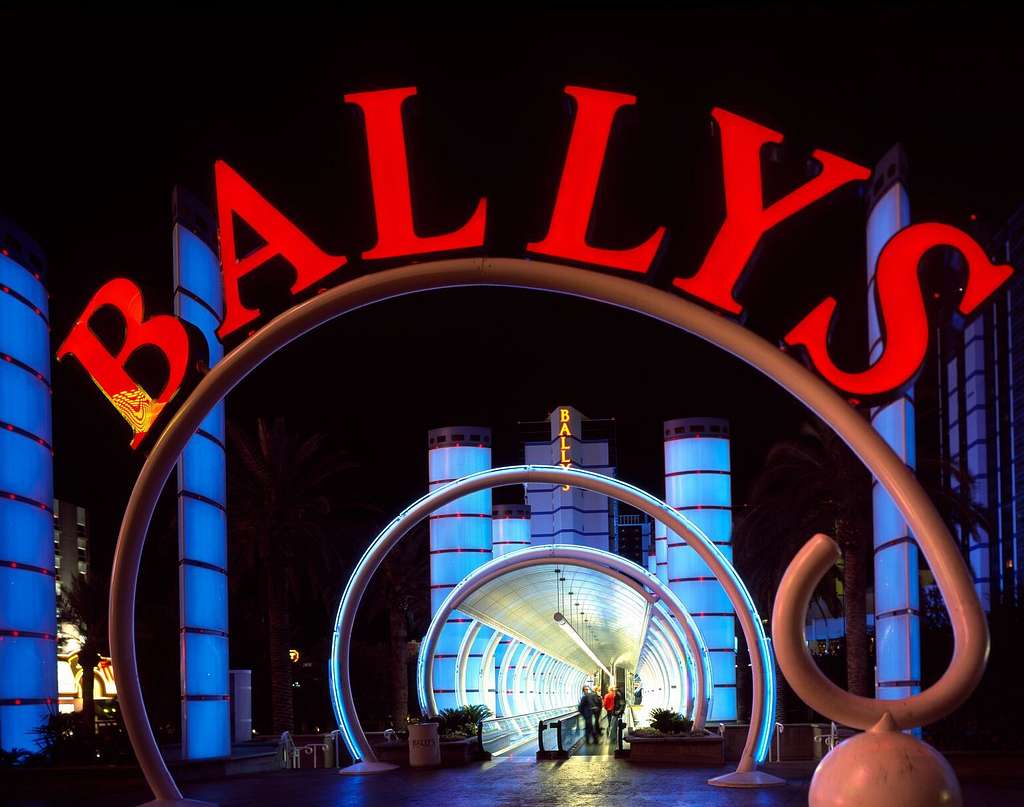

Widerström told investors that the group had already identified retail shops “that are no longer sustainable.” He said closures were part of broader cost-saving measures. Widerström reiterated that the group continues to assess strategic options, including the potential sale of all or part of the business.

Mixed financial picture

Despite confirming closures, Evoke reported some positive figures for the final quarter of 2025. Total revenue for the three-month period was approximately £464m. This is the strongest quarter of the year, although it was slightly down compared with the same period in 2024.

The group’s gaming division, including online casino brands, showed growth in the quarter. Betting revenue was weaker, which is shown in comparisons with the prior year.

Overall full-year revenue for 2025 was projected to be up about 2 per cent year-on-year.

Strategic review and industry outlook

Evoke launched a formal strategic review in December 2025. It said that the shifting tax and regulatory landscape in the UK made it difficult to issue reliable financial guidance for 2026. Analysts and industry observers have suggested this review could result in a sale or break-up of parts of the business, including its retail arm.

The Williams Hill retail estate (historically one of the UK’s largest networks of bookmakers) is made up of around 1,400 shops. How many of these will ultimately close remains unclear. The confirmed closures mark one of the most significant adjustments in the operator’s retail footprint in recent years.

Evoke’s move comes amid a broader shift in the gambling sector. Operators are having to balance high street costs against the rapid growth of online betting and tighter regulatory and tax environments.

_for_$2.25_Billion.jpeg)