A leaked Whitehall consultation has thrown the spotlight back onto the funding of the UK gambling regulator, after proposals emerged to raise licence fees by as much as 30%. The plans, published briefly before being taken down, form part of a wider review into how the Gambling Commission is funded. With the regulator warning that its financial reserves are close to being exhausted, the consultation has reopened a sensitive debate over how much of the growing cost of regulation should be borne by the industry.

Whitehall leak reignites debate over 30% gambling licence fee rise

UK gambling regulation under financial pressure, Nick Youngson CC BY-SA 3.0 Pix4free.org

Key Takeaways

- Whitehall leak reveals proposed 30% rise in gambling licence fees

- Industry warns of higher costs and reduced market competitiveness

- Plans emerge amid wider tax and regulatory pressure on operators

Why are licence fees back under review?

The consultation, launched by the Department for Culture, Media and Sport (DCMS), is the first full review of Gambling Commission fees since 2021. It follows several years of increased regulatory activity, including:

- Work to disrupt the illegal gambling market.

- Reforms set out in the Gambling Act Review White Paper.

- Improvements in the Commission’s data and intelligence capabilities.

These expanded responsibilities, combined with inflationary pressures, have left the regulator running annual budget deficits.

In the 2024/25 financial year, the Commission drew £3.1 million from its reserves, with a further £5 million forecast for 2025/26. By the end of that period, reserves are expected to sit close to the Commission’s minimum operating level of £4 million.

Without changes to fee levels, the Government warns that reserves could be fully depleted during 2026/27.

"Since 2021, the income that the Gambling Commission receives in respect of some types of licence has drifted away from the actual costs of regulating them, and the costs to the Commission of regulation now increasingly exceeds the level of the fee set in 2021." - Department for Culture, Media & Sport, open consultation and proposed changes to Gambling Commision fees

Three fee increase options on the table

To address the funding gap, the consultation sets out three potential approaches to increasing annual operating licence fees:

- Option 1: A flat 30% increase across fees

- Option 2: A 20% increase

- Option 3: A 20% increase plus an additional 10% ringfenced for tackling illegal gambling and protecting licensed operators from criminal activity

A full 30% increase would generate an additional £8.7 million in funding once fully implemented.

Impact on operators and who pays most

While the headline percentage increase has drawn attention, the consultation highlights that the majority of the financial impact would fall on larger operators. Small businesses (defined as those with gross gambling yield (GGY) of up to £15 million per licence type) make up 96% of all licences. These would contribute just 8% of the total increase in fee income.

The remaining 4% of licence types (operators with GGY above £15 million) would account for 92% of the additional revenue raised.

What happens next?

Any fee changes would be introduced through secondary legislation. DCMS is aiming for new rates to come into effect from 1 October 2026. The consultation is open until 29 March 2026.

The Government has also signalled longer-term structural changes. In future, and subject to Parliamentary time, the Gambling Commission could be given greater autonomy to consult on and implement fee changes itself. This would bring it into line with regulators like Ofcom and the Financial Conduct Authority.

Content writer specializing in online casinos and sports betting, currently writing for Casino.com. With 7+ years of experience in the iGaming industry, I create expert content on real money casinos, bonuses, and game guides. My background also includes writing across travel, business, tech, and sports, giving me a broad perspective that helps explain complex topics in a clear and engaging way.

Related News

South Africa Extends Public Comment Deadline on Proposed Online Gambling Tax

National Treasury has pushed back the deadline for public comments on its draft online gambling tax proposals, giving stakeholders until 27 February 2026 to respond.

_for_$2.25_Billion.jpeg)

Clorox to Purchase Gojo Industries (Purell Maker) for $2.25 Billion

Clorox is purchasing Gojo Industries, the company behind Purell, for $2.25 billion.

UK Government Confirms Increased Taxes on Online Gambling Activities

The revised tax framework, targeting remote betting and online casinos, projects to generate over £1 billion annually in tax revenue.

SkyCity Confirms 19 February Results Date as NZICC Opening Nears

SkyCity has set 19 February 2026 for its half-year results release, as the NZICC prepares to open in central Auckland on 11 February 2026.

Netflix Revamps Warner Bros. Discovery Deal With $72B All-Cash Offer

Netflix moved to a $72B all-cash deal for Warner Bros. Discovery, aiming to speed approval and counter a rival bid.

Mixed feelings emerge as gambling tax reforms return to the spotlight

The UK government’s renewed focus on gambling taxation has triggered a divided response across the industry, with operators warning of unintended consequences while policymakers argue reform is overdue.

Following Netflix/Warner Deal, President Donald Trump Purchased Bonds

Following the announcement of the Netflix-Warner deal, President Trump purchased bonds.

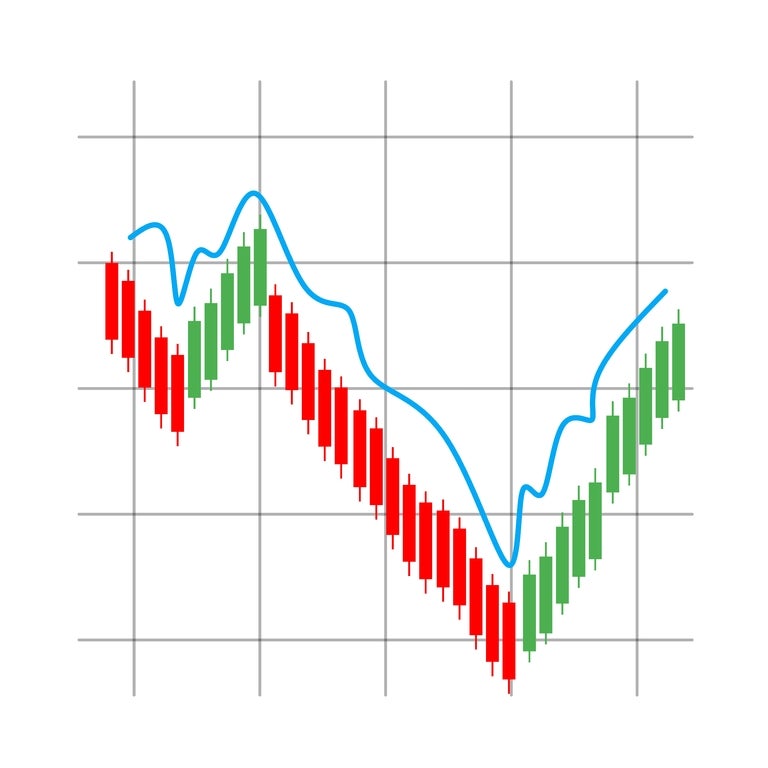

Playtech shares hold above 50-day moving average as selling pressure eases

Playtech shares have continued to trade above their 50-day moving average following a volatile start to the year. While recent price action shows the stock remains down over the past month, holding this technical level may indicate easing selling pressure and a more stable near-term outlook.

Bain Capital To Make Bob's Discount Furniture Public, Files for IPO

The long-time furniture chain, Bob's Discount Furniture, has filed for its initial public offering.

MGM China and Melco Continue Tradition of Discretionary Staff Bonuses

MGM China and Melco award about 96% of employees an extra month’s salary for 2025 work, continuing Macau casino’s annual year-end bonus tradition.

South African Treasury Department Proposes 20% Online Gambling Tax

South Africa’s National Treasury has proposed a new 20% tax on online gambling revenue. We break down the proposal and its potential impact.

Lotte’s Jeju Dream Tower 2025 Casino Sales Jump 62% to US$330 Million

Jeju casino sales surged 62% to KRW476B (US$330M), driven by a 54% visitor spike to 590,000, per unaudited Korea Exchange filings and operator data.

NZ Online Casino Bill 2026: Government Bans Credit Cards as Banks Tighten Gambling Controls

New Zealand banks continue to apply restrictions to gambling-related payments, especially for offshore casinos. We explain what players should know.

Nevada Rep. Titus Pushing for Late-Minute Gambling Tax Changes

Under the 90 percent structure, which will go into effect next year, gamblers could owe money in taxes in net-negative years.

Resorts World NYC Hopes to Lower Tax Commitment for Proposed Casino

...Tax proposals of 56 percent on slot machine revenue and 30 percent on table games, which are well above industry standard.

Norfolk Casino Will Generate Less than 50% of Expected Tax Revenue

The Pamunkey Indian Tribe, which received federal recognition in 2015, was awarded the title of majority owner of the Norfolk project before construction ever began.

Illinois’ Casino Industry Surges 21% YoY During Favorable October

The Illinois Gaming Board revealed in its monthly revenue report that the retail gaming industry generated $165.8 million in October revenue.

Ohio Retail Casino Market Produced $88.9 Million in July, Grows 8.4 Percent YoY

Revenue reached $88.9 million during the period, led by $24.7 million, an 11.3 percent YoY increase, by Hollywood Columbus Casino.

Delaware Casinos Underperform Compared to Figures from July 2024

According to a report published by the Delaware Lottery, the state’s casino market procured $34.8 million in revenue during July.

Macau Posts Best Month Since COVID Outbreak, Hits $2.6 Billion in Revenue

Macau Casinos Post Best Month Since COVID

Atlantic City Casinos Falter Again, New Jersey iGaming Flourishes

Atlantic City Casinos Struggle

Atlantic City Casinos Profitable, But Most Made Less Money than in 2023

Atlantic City Casinos' Bottom Line Drops

Companies Spend Big on Lobbyists Amid Hunt for Three New York Casino Licenses

Casino Groups Spend Big in NY

Macau Casinos To Feel the Effects of Trump’s America First Investment Policy

Trump's Policy to Hurt Macau Casinos?

Eagles’ Success Stalls Pennsylvania Casinos, Overall Gaming Revenue Still Up

Eagles Halt PA's Gambling Progress

Virginia Casino Market Hits New Heights, Poised for Continued Growth

Virginia Casino Market Booms

Hedge Fund Standard General Finalizes $4.6 Billion Acquisition of Bally’s

$4.6 Billion Bally's Deal Finalized

Michigan Retail and Online Casinos Help Drive Record-Setting Year

Michigan Posts Record Year for Gaming

New Jersey Online Casinos Set Record, Retail Gaming Regains Lead

NJ Online Casinos Set Another Record

Hard Rock in Bristol, VA Sets Monthly Record Immediately After Big Move

Hard Rock Bristol Sets New Records

New Jersey Online Casinos Smash $200 Million in September Revenue

New Jersey Online Casinos Set Records

Super Slot Machine Success Powers Virginia Casino Growth

Virginia Casino Industry Enjoys Growth