Novomatic’s long-running effort to complete a full takeover of Ainsworth Game Technology has officially collapsed. The Austrian gaming group failed to secure sufficient minority shareholder support before the final 6 February deadline. As a result, the transaction implementation deed has been terminated. Novomatic will continue as majority shareholder still and will maintain control of approximately 66.6% of the company alongside founder Johann Graf whose $11B net worth is all self-made.

Novomatic takeover of Ainsworth collapses after deadline

Novomatic takeover of Ainsworth collapses after deadline, Wikimedia Commons, CC BY-SA 3.0 AT

Key Takeaways

- Novomatic required minority shareholder approval to complete the deal

- Initial AU$1 per share bid represented a 35% premium

- Novomatic retains approximately 66.6% control of Ainsworth

Minority support proves decisive

Since it acquired a 52.9% stake in Ainsworth in January 2018, Novomatic has held a controlling interest. Last year, it started the process to acquire the remaining shares to take the Australian slot manufacturer fully private.

Ainsworth’s independent board committee backed the original offer of AU$1 per share. The bid represented a 35% premium on the last closing share price prior to the proposal. Novomatic made clear it would not raise the offer.

A revised proposal in August mirrored the earlier terms but was treated as an alternative takeover bid running in parallel. Again, the committee recommended shareholders accept, with no superior proposal being offered.

There was incremental progress. Novomatic increased its stake to 59.8% through acceptances during 2025. However, the company ultimately fell short of the required threshold. Multiple deadline extensions, first to December, then January, and finally 6 February, were not enough. There simply wasn’t sufficient backing from minority investors.

Strategic fit remains clear

At the time the deal was first announced, Novomatic executive board member Stefan Krenn described the acquisition as strategically aligned with the group’s international growth ambitions. Ainsworth’s footprint in Asia-Pacific and North America was seen as complementary to Novomatic’s global expansion plans, as a group with a presence in 50 countries already.

While the full takeover has now failed, Novomatic still controls approximately two-thirds of Ainsworth. Operational influence, therefore, remains firmly in its hands.

"For many years, Novomatic has been exemplary in the areas that define a leading company: international technological innovation on the one hand and a clear commitment to its location, employees, and society on the other." - Monica Rintersbacher, Managing Director of Leitbetriebe Austria

Wider portfolio reshaping

The breakdown of the Ainsworth bid comes during a broader period of portfolio adjustment for Novomatic. In 2025, the group acquired French casino operator Vikings Casino. This meant expansion of its land-based presence in France to around 1,000 gaming terminals across 11 venues.

Conversely, Novomatic also streamlined domestically. It sold its Austrian Admiral business to Tipico Group as part of a strategic move to international markets.

What happens next?

With the takeover no longer proceeding, Ainsworth will remain listed, albeit under majority Novomatic control. Investors will now watch whether Novomatic revisits a full acquisition attempt in the future.

For now, the message is clear. Novomatic came close. But without minority approval, the final step proved just out of reach.

Paul Skidmore is a content writer specializing in online casinos and sports betting, currently writing for Casino.com. With 7+ years of experience in the iGaming industry, I create expert content on real money casinos, bonuses, and game guides. My background also includes writing across travel, business, tech, and sports, giving me a broad perspective that helps explain complex topics in a clear and engaging way.

Related News

Macau’s Gaming Activity Slows in Early February Ahead of CNY

Despite the slow start, analysts maintain February revenue forecasts, projecting a 4% increase compared to February 2025.

UK Payments Enter a New Era of Efficiency and Innovation

The UK’s payment overhaul aims to reduce costs for smaller merchants, addressing the significant fees they face compared to larger businesses.

Macau’s Casino Revenue Climbs 24% in January, Signaling Recovery

Macau’s GDP grew 7.6% in Q4 2025, followed by a 24% casino revenue surge in January 2026, driven by tourism gains and stronger domestic demand.

PepsiCo Beats Earnings Estimates as It Prepares to Cut Snack Prices

PepsiCo will decrease prices on several snack items in 2026.

GameStop CEO Teases a “Very Big” Deal That Could Transform Company

GameStop appears poised to attempt to make an acquisition that would be "transformational" to the company, but no target was named.

South Africa Extends Public Comment Deadline on Proposed Online Gambling Tax

National Treasury has pushed back the deadline for public comments on its draft online gambling tax proposals, giving stakeholders until 27 February 2026 to respond.

_for_$2.25_Billion.jpeg)

Clorox to Purchase Gojo Industries (Purell Maker) for $2.25 Billion

Clorox is purchasing Gojo Industries, the company behind Purell, for $2.25 billion.

UK Government Confirms Increased Taxes on Online Gambling Activities

The revised tax framework, targeting remote betting and online casinos, projects to generate over £1 billion annually in tax revenue.

SkyCity Confirms 19 February Results Date as NZICC Opening Nears

SkyCity has set 19 February 2026 for its half-year results release, as the NZICC prepares to open in central Auckland on 11 February 2026.

Netflix Revamps Warner Bros. Discovery Deal With $72B All-Cash Offer

Netflix moved to a $72B all-cash deal for Warner Bros. Discovery, aiming to speed approval and counter a rival bid.

Mixed feelings emerge as gambling tax reforms return to the spotlight

The UK government’s renewed focus on gambling taxation has triggered a divided response across the industry, with operators warning of unintended consequences while policymakers argue reform is overdue.

Following Netflix/Warner Deal, President Donald Trump Purchased Bonds

Following the announcement of the Netflix-Warner deal, President Trump purchased bonds.

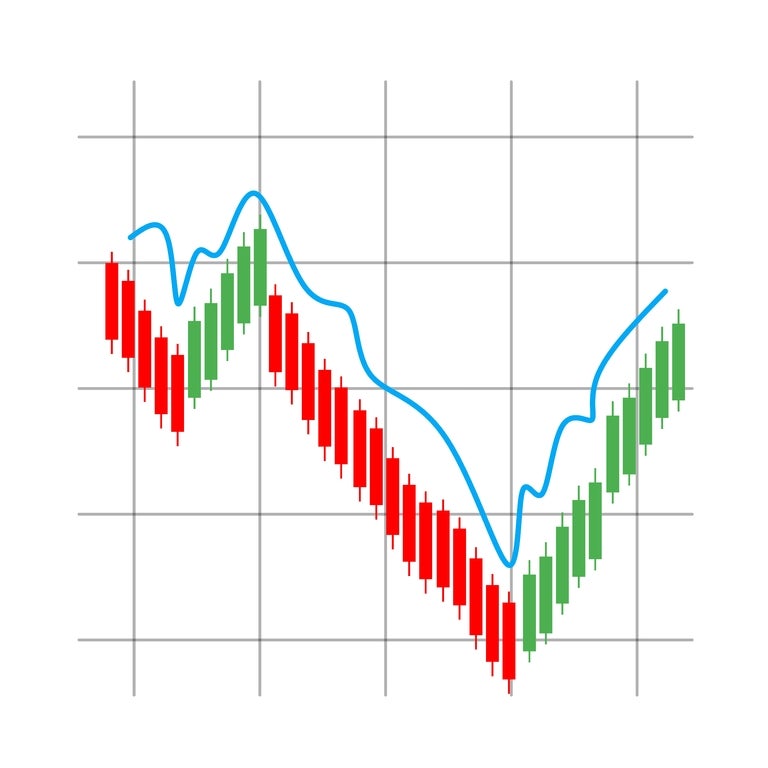

Playtech shares hold above 50-day moving average as selling pressure eases

Playtech shares have continued to trade above their 50-day moving average following a volatile start to the year. While recent price action shows the stock remains down over the past month, holding this technical level may indicate easing selling pressure and a more stable near-term outlook.

Bain Capital To Make Bob's Discount Furniture Public, Files for IPO

The long-time furniture chain, Bob's Discount Furniture, has filed for its initial public offering.

MGM China and Melco Continue Tradition of Discretionary Staff Bonuses

MGM China and Melco award about 96% of employees an extra month’s salary for 2025 work, continuing Macau casino’s annual year-end bonus tradition.

South African Treasury Department Proposes 20% Online Gambling Tax

South Africa’s National Treasury has proposed a new 20% tax on online gambling revenue. We break down the proposal and its potential impact.

Lotte’s Jeju Dream Tower 2025 Casino Sales Jump 62% to US$330 Million

Jeju casino sales surged 62% to KRW476B (US$330M), driven by a 54% visitor spike to 590,000, per unaudited Korea Exchange filings and operator data.

NZ Online Casino Bill 2026: Government Bans Credit Cards as Banks Tighten Gambling Controls

New Zealand banks continue to apply restrictions to gambling-related payments, especially for offshore casinos. We explain what players should know.

Nevada Rep. Titus Pushing for Late-Minute Gambling Tax Changes

Under the 90 percent structure, which will go into effect next year, gamblers could owe money in taxes in net-negative years.

Resorts World NYC Hopes to Lower Tax Commitment for Proposed Casino

...Tax proposals of 56 percent on slot machine revenue and 30 percent on table games, which are well above industry standard.

Norfolk Casino Will Generate Less than 50% of Expected Tax Revenue

The Pamunkey Indian Tribe, which received federal recognition in 2015, was awarded the title of majority owner of the Norfolk project before construction ever began.

Illinois’ Casino Industry Surges 21% YoY During Favorable October

The Illinois Gaming Board revealed in its monthly revenue report that the retail gaming industry generated $165.8 million in October revenue.

Ohio Retail Casino Market Produced $88.9 Million in July, Grows 8.4 Percent YoY

Revenue reached $88.9 million during the period, led by $24.7 million, an 11.3 percent YoY increase, by Hollywood Columbus Casino.

Delaware Casinos Underperform Compared to Figures from July 2024

According to a report published by the Delaware Lottery, the state’s casino market procured $34.8 million in revenue during July.

Macau Posts Best Month Since COVID Outbreak, Hits $2.6 Billion in Revenue

Macau Casinos Post Best Month Since COVID

Atlantic City Casinos Falter Again, New Jersey iGaming Flourishes

Atlantic City Casinos Struggle

Atlantic City Casinos Profitable, But Most Made Less Money than in 2023

Atlantic City Casinos' Bottom Line Drops

Companies Spend Big on Lobbyists Amid Hunt for Three New York Casino Licenses

Casino Groups Spend Big in NY

Macau Casinos To Feel the Effects of Trump’s America First Investment Policy

Trump's Policy to Hurt Macau Casinos?

Eagles’ Success Stalls Pennsylvania Casinos, Overall Gaming Revenue Still Up

Eagles Halt PA's Gambling Progress

Virginia Casino Market Hits New Heights, Poised for Continued Growth

Virginia Casino Market Booms

Hedge Fund Standard General Finalizes $4.6 Billion Acquisition of Bally’s

$4.6 Billion Bally's Deal Finalized

Michigan Retail and Online Casinos Help Drive Record-Setting Year

Michigan Posts Record Year for Gaming