Reforming the UK’s Payment Infrastructure

The rationale for overhauling the UK’s payment infrastructure is grounded in economic realities, particularly the high costs of card payments, which affect smaller merchants.

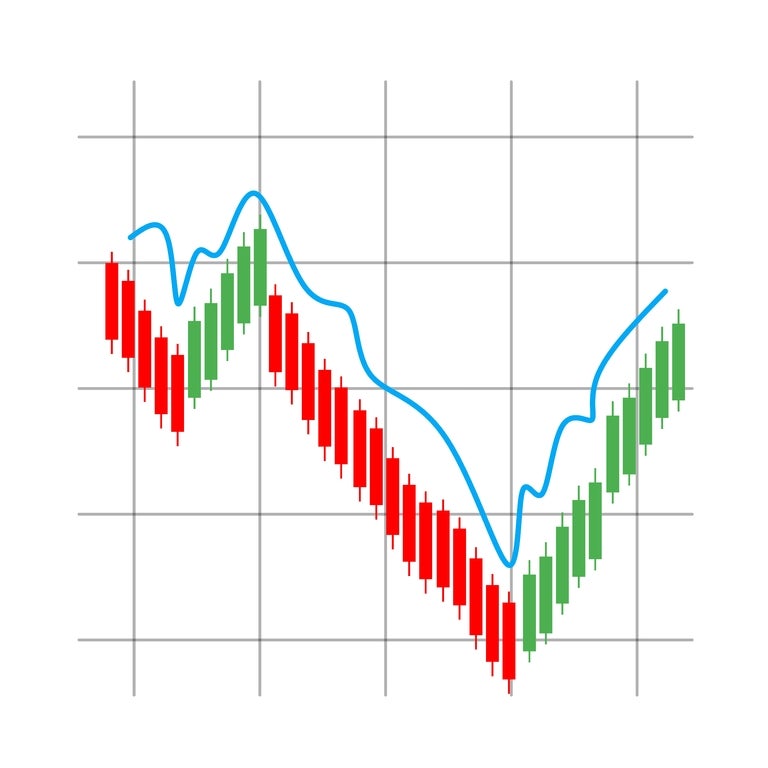

A recent review by the Payment Systems Regulator revealed that UK merchants incur an average fee of 0.6% per transaction for card acceptance. It showed that the smallest vendors face costs more than four times higher than their larger counterparts,

The financial burden often translates to increased prices for consumers. The proposed account-to-account payment solutions aim to reduce these expenses significantly. The transition is under the guidance of the new Retail Payments Infrastructure Board. The Bank of England is set to design a system that not only reduces costs but also introduces innovative transaction types, such as automated payments linked to delivery confirmations.

Vision for a Multi-Money Ecosystem

The Bank of England is working to establish a “multi-money” ecosystem that facilitates seamless exchanges among various forms of currency. This includes deposits, tokenized deposits, systemic stablecoins, and a potential retail central bank digital currency (CBDC), known as a digital pound.

Deputy governor Sarah Breeden highlights the need for interoperability. She warns that without it, “we risk a coordination problem” that could stifle innovation and concentrate power in a few large entities. To tackle this issue, the government plans to finalize a regulatory framework for systemic stablecoins by 2026. In the meantime, the Bank of England is promoting innovation through initiatives such as the Digital Pound Lab and the RTG Synchronisation Lab, which enable firms to test new payment methods and integrate tokenized transactions.

Distinctive UK Governance Model

The UK’s payment infrastructure reform stands out due to its robust governance framework. The Payments Vision Delivery Committee, which includes HM Treasury, the Bank of England, PSR, and FCA, outlines key outcomes. The Bank of England leads the design process, collaborating with the Retail Payments Infrastructure Board, while a private sector delivery company manages funding and construction. This model seeks to align public policy goals with commercial interests and technological advancements, promising faster, more affordable payments.

_for_$2.25_Billion.jpeg)