On Tuesday, PepsiCo reported quarterly earnings and revenue that topped expectations, with organic sales improving.

PepsiCo Beats Earnings Estimates as It Prepares to Cut Snack Prices

Photo by Wikimedia Commons, CC BY 2.0

Key Takeaways

- PepsiCo's revenue of $29.34 billion beat the expected $28.97 billion

- PepsiCo will reduce the price of several snack options

- The options include Lays, Tostitos, Doritos and Cheetos

Lower Snack Prices Coming

Snacks under PepsiCo, such as Doritos and Tostitos, have been down due to the prices. In response, Pepsi said it plans to lower prices on products such as its chip options. This will be done to “improve competitiveness and the purchase frequency of our brands."

To help offset the loss of revenue, PepsiCo says productivity savings will offset the lower prices.

Also on Tuesday, PepsiCo shares were nearly 5% higher.

The brands that'll see a price reduction include Lays, Tostitos, Doritos, and Cheetos.

PepsiCo is cutting prices after receiving a flood of emails and voicemail messages from shoppers complaining that high prices were making it hard to buy the company’s snacks. 🔗 https://t.co/n2h5D0FJcK pic.twitter.com/D2VWFvQ6Mp

— The Wall Street Journal (@WSJ) February 3, 2026

Reported vs. Expected Revenue and Earnings Figures

Below are the figures of what PepsiCo reported versus what was expected. The expected figures come from a survey of LSEG analysts, per CNBC.

- Earnings per share: $2.26 adjusted vs. $2.24 expected

- Revenue: $29.34 billion vs. $28.97 billion expected

Also, PepsiCo reported $2.54 billion in fourth-quarter net income ($1.85 per share), up from $1.52 billion ($1.11 per share) a year earlier.

Net sales rose 5.6% to $29.34 billion. Furthermore, organic revenue, excluding foreign currency effects, divestitures, and acquisitions, increased 2.1%.

“PepsiCo’s fourth quarter results reflected a sequential acceleration in reported and organic revenue growth, with improvements in both the North America and International businesses,” CEO Ramon Laguarta said in a statement.

In North America, PepsiCo Beverages, which includes drinks like Gatorade and Starry, saw volume decline 4%, while sales rose 2%.

As for the food division, volume fell by 1%.

With price decreases coming, PepsiCo expects double-digit increases in shelf space with top retailers.

2026 Outlook and Recent Deal

In 2026, PepsiCo projected organic revenue growth of 2%-4%.

This past December, PepsiCo and Elliott Investment Management struck a deal for a $4 billion stake in the company, with the focus being on cutting some of the lineup of options, cutting costs, and lowering snack prices. Elliott doesn't have a seat on the PepsiCo board.

Finally, Laguarta believes the North American arm of the business will improve while internationally they'll remain "resilient."

Richard Janvrin is a graduate of the University of New Hampshire. He started writing as a teenager before breaking into sports coverage professionally in 2015. From there, he entered the iGaming space in 2018 and has covered numerous aspects, including news, reviews, bonuses/promotions, sweepstakes casinos, legal, and more.

Related News

GameStop CEO Teases a “Very Big” Deal That Could Transform Company

GameStop appears poised to attempt to make an acquisition that would be "transformational" to the company, but no target was named.

South Africa Extends Public Comment Deadline on Proposed Online Gambling Tax

National Treasury has pushed back the deadline for public comments on its draft online gambling tax proposals, giving stakeholders until 27 February 2026 to respond.

_for_$2.25_Billion.jpeg)

Clorox to Purchase Gojo Industries (Purell Maker) for $2.25 Billion

Clorox is purchasing Gojo Industries, the company behind Purell, for $2.25 billion.

UK Government Confirms Increased Taxes on Online Gambling Activities

The revised tax framework, targeting remote betting and online casinos, projects to generate over £1 billion annually in tax revenue.

SkyCity Confirms 19 February Results Date as NZICC Opening Nears

SkyCity has set 19 February 2026 for its half-year results release, as the NZICC prepares to open in central Auckland on 11 February 2026.

Netflix Revamps Warner Bros. Discovery Deal With $72B All-Cash Offer

Netflix moved to a $72B all-cash deal for Warner Bros. Discovery, aiming to speed approval and counter a rival bid.

Mixed feelings emerge as gambling tax reforms return to the spotlight

The UK government’s renewed focus on gambling taxation has triggered a divided response across the industry, with operators warning of unintended consequences while policymakers argue reform is overdue.

Following Netflix/Warner Deal, President Donald Trump Purchased Bonds

Following the announcement of the Netflix-Warner deal, President Trump purchased bonds.

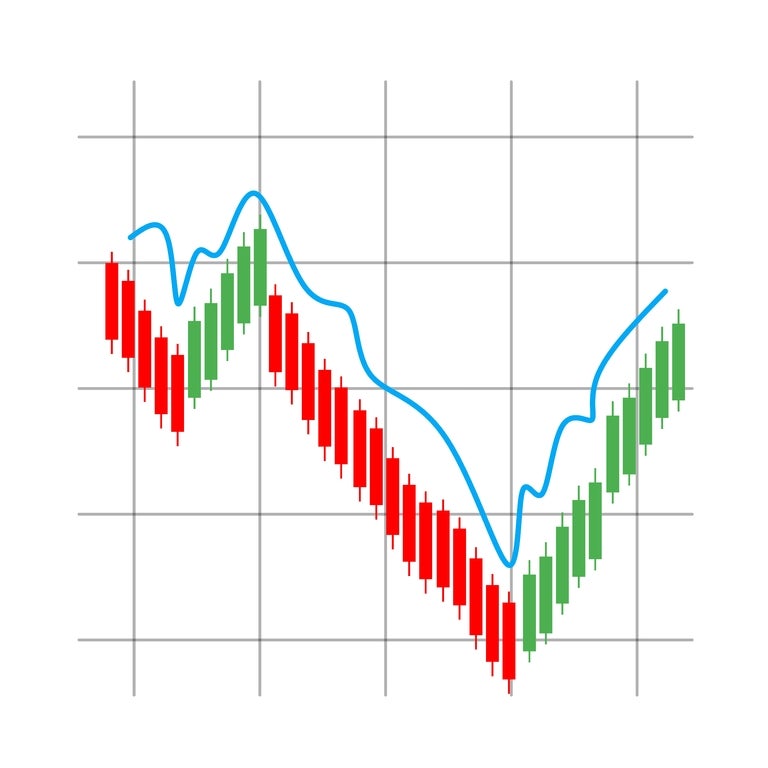

Playtech shares hold above 50-day moving average as selling pressure eases

Playtech shares have continued to trade above their 50-day moving average following a volatile start to the year. While recent price action shows the stock remains down over the past month, holding this technical level may indicate easing selling pressure and a more stable near-term outlook.

Bain Capital To Make Bob's Discount Furniture Public, Files for IPO

The long-time furniture chain, Bob's Discount Furniture, has filed for its initial public offering.

MGM China and Melco Continue Tradition of Discretionary Staff Bonuses

MGM China and Melco award about 96% of employees an extra month’s salary for 2025 work, continuing Macau casino’s annual year-end bonus tradition.

South African Treasury Department Proposes 20% Online Gambling Tax

South Africa’s National Treasury has proposed a new 20% tax on online gambling revenue. We break down the proposal and its potential impact.

Lotte’s Jeju Dream Tower 2025 Casino Sales Jump 62% to US$330 Million

Jeju casino sales surged 62% to KRW476B (US$330M), driven by a 54% visitor spike to 590,000, per unaudited Korea Exchange filings and operator data.

NZ Online Casino Bill 2026: Government Bans Credit Cards as Banks Tighten Gambling Controls

New Zealand banks continue to apply restrictions to gambling-related payments, especially for offshore casinos. We explain what players should know.

Nevada Rep. Titus Pushing for Late-Minute Gambling Tax Changes

Under the 90 percent structure, which will go into effect next year, gamblers could owe money in taxes in net-negative years.

Resorts World NYC Hopes to Lower Tax Commitment for Proposed Casino

...Tax proposals of 56 percent on slot machine revenue and 30 percent on table games, which are well above industry standard.

Norfolk Casino Will Generate Less than 50% of Expected Tax Revenue

The Pamunkey Indian Tribe, which received federal recognition in 2015, was awarded the title of majority owner of the Norfolk project before construction ever began.

Illinois’ Casino Industry Surges 21% YoY During Favorable October

The Illinois Gaming Board revealed in its monthly revenue report that the retail gaming industry generated $165.8 million in October revenue.

Ohio Retail Casino Market Produced $88.9 Million in July, Grows 8.4 Percent YoY

Revenue reached $88.9 million during the period, led by $24.7 million, an 11.3 percent YoY increase, by Hollywood Columbus Casino.

Delaware Casinos Underperform Compared to Figures from July 2024

According to a report published by the Delaware Lottery, the state’s casino market procured $34.8 million in revenue during July.

Macau Posts Best Month Since COVID Outbreak, Hits $2.6 Billion in Revenue

Macau Casinos Post Best Month Since COVID

Atlantic City Casinos Falter Again, New Jersey iGaming Flourishes

Atlantic City Casinos Struggle

Atlantic City Casinos Profitable, But Most Made Less Money than in 2023

Atlantic City Casinos' Bottom Line Drops

Companies Spend Big on Lobbyists Amid Hunt for Three New York Casino Licenses

Casino Groups Spend Big in NY

Macau Casinos To Feel the Effects of Trump’s America First Investment Policy

Trump's Policy to Hurt Macau Casinos?

Eagles’ Success Stalls Pennsylvania Casinos, Overall Gaming Revenue Still Up

Eagles Halt PA's Gambling Progress

Virginia Casino Market Hits New Heights, Poised for Continued Growth

Virginia Casino Market Booms

Hedge Fund Standard General Finalizes $4.6 Billion Acquisition of Bally’s

$4.6 Billion Bally's Deal Finalized

Michigan Retail and Online Casinos Help Drive Record-Setting Year

Michigan Posts Record Year for Gaming

New Jersey Online Casinos Set Record, Retail Gaming Regains Lead

NJ Online Casinos Set Another Record

Hard Rock in Bristol, VA Sets Monthly Record Immediately After Big Move

Hard Rock Bristol Sets New Records

New Jersey Online Casinos Smash $200 Million in September Revenue

New Jersey Online Casinos Set Records

Super Slot Machine Success Powers Virginia Casino Growth

Virginia Casino Industry Enjoys Growth