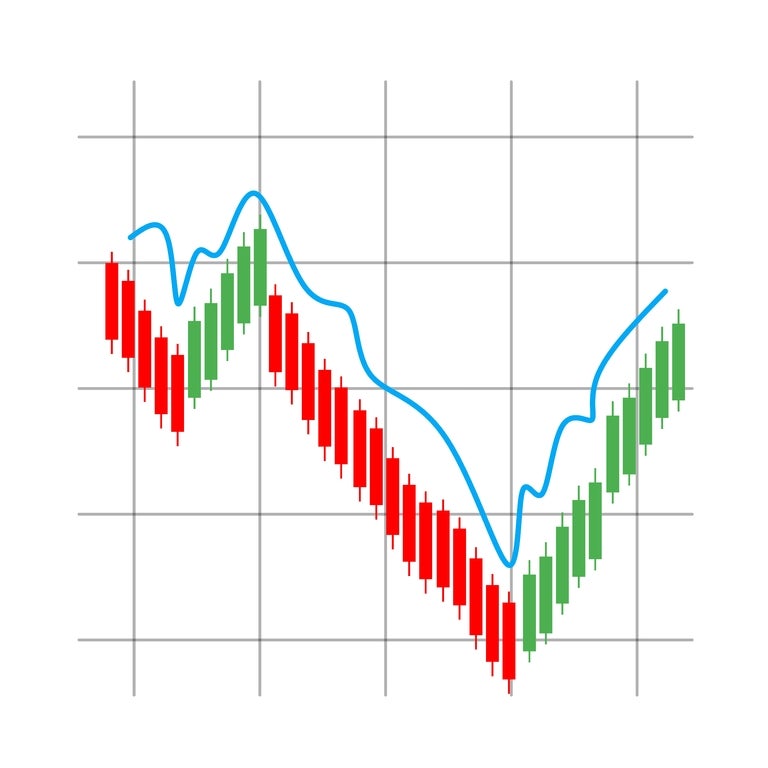

VIP and Mass Gaming Revenue Declines

Recent industry data shows a notable decline in VIP gaming activity, down 12-14% compared to January. Similarly, mass-market revenue has decreased by approximately 11-13% during the same timeframe.

Analysts note that hold rates in VIP gaming remain stable, suggesting that changes in revenue are primarily driven by volume fluctuations rather than win rate variations.

Tourist indicators also shed light on the softer gaming figures. Early February marks a peak travel period in China, as many return to their hometowns. Some analysts believe this indicates the casino visits may simply be postponed within the holiday cycle.

February Revenue Projections Remain Steady

Despite a slower start to February, analysts are maintaining their full-month forecasts for the gaming sector. Current projections estimate gross gaming revenue for the month at MOP20.5 billion, indicating a potential 4% increase compared to February 2025. If these figures hold, the expected daily average for the remainder of the month would be close to MOP775 million.

The combined performance of January and February is being closely monitored due to variations in the timing of the Chinese New Year. Estimates suggest a total of approximately MOP43.1 billion over the two months. This reflects a year-on-year growth of about 13.5% after adjusting for calendar differences. January alone brought in MOP22.6 billion, a 24% increase from the previous year.

Optimism for Holiday Demand

Industry experts are optimistic about holiday demand, with operators reporting strong booking levels ahead of the festive season. This year, the Chinese New Year falls on February 17, with a nine-day holiday period commencing on February 15 in mainland China. Despite the earlier decline in gaming revenue, border traffic statistics reveal robust visitor movement.

Authorities noted 867,000 cross-border movements on February 7, marking the highest daily total recorded. Tourists made up about 40% of these crossings, with around 174,000 entering Macau that day. The Border Gate checkpoint alone processed nearly 463,000 passenger movements, the busiest flow in five years.

_for_$2.25_Billion.jpeg)