GameStop CEO Doesn't Name The Target

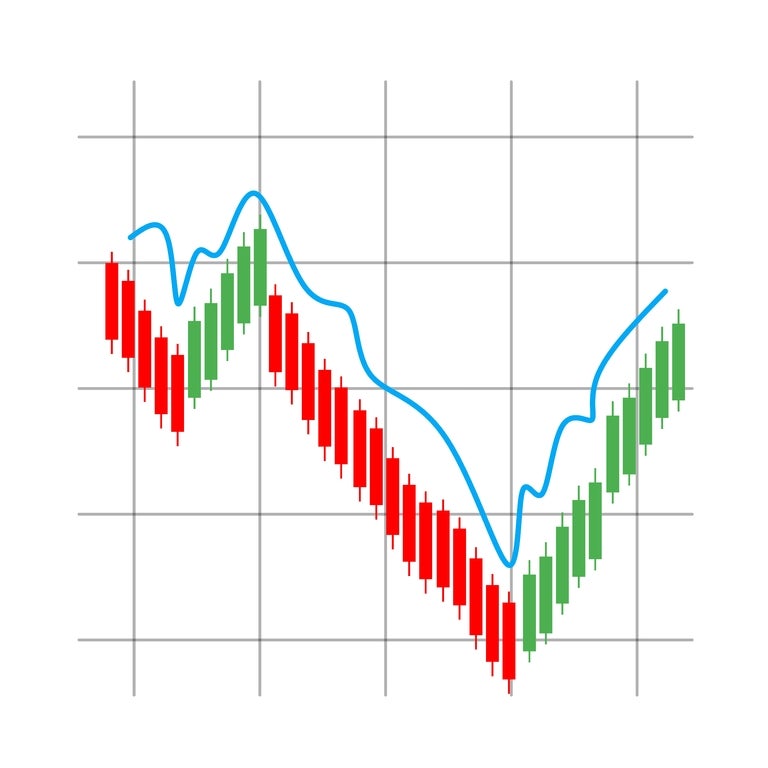

“It’s gonna be really big. Really big. Very, very, very big,” Cohen said of the size of the acquisition. “It’s transformational. Not just for GameStop, but ultimately, within the capital markets … this is something that really has never been done before within the history of the capital markets.”

During the interview with CNBC, Cohen didn't name the company's targets. However, he did mention that he's seeking a publicly traded company that's no only undervalued, but also “high quality, durable, scalable with growth prospects” and also possesses a “sleepy management team."

Cohen went as far as to say that the deal would have the “potential to make [GameStop] worth several hundreds of billions of dollars.”

In January, GameStop revealed a new "all-or-bothing equity incentive." Thus,Cohen is only paid out if it reaches a market cap of $100 billion and sees $10 billion in cumulative earnings before interest, taxes, deprectiation, and amortization.

More Cohen Comments

“If it works, it’s genius. If it doesn’t work, then, you know, it will be totally, totally foolish,” Cohen said. “But I believe we have the components to make it work, and I’m very confident in the ability to make the asset much, much, much more efficient … we’ve got the governance structure, we’ve got the capital, we have the operational expertise.”

As CNBC noted, yes, Cohen has turned GameStop from a potentially dying retail business to making money, but it's unclear what acquisition could increase its worth by $100 billion. Also, GameStop has a market cap of $10.5 billion.

Cohen took over as GameStop CEO in September 2023 and the company has cut many costs and improved profitability.

CNBC asked Cohen if GameStop would be willing to part with its bitcoin holdings to fund an acquisition, but he didn't say.

Investment Banker Skeptical, Michael Burry Isn't

In the CNBC interview, they also provided thoughts of an investment banker in the consumer and retail space.

This individual, per CNBC, was skeptical Cohen could pull it off. Additionally, this person said there are very few businesses that could accomplish what Cohen is saying.

“I’ve never seen it,” the person said. “Unless you’re talking about radically transforming a business model or something, it just doesn’t happen in retail.”

There was also another invesment banker who agreed with the other investment banker CNBC noted.

“It’s easy to say something,” the person said. “It’s a lot harder to do it.”

While they may be skeptical, Michael Burry, the investor referenced in "The Big Short," is buying shares in GameStop.

“Ryan is making lemonade out of lemons,” Burry said in a Monday Substack post. “He has a crappy business, and he is milking it best he can while taking advantage of the meme stock phenomenon to raise cash and wait for an opportunity to make a big buy of a real growing cash cow business.”

_for_$2.25_Billion.jpeg)