Warner Bros. again rejected Paramount's latest bid, which was for nearly $78 billion. While this is more than Netflix's $72 billion, Warner Bros.' board said Paramount’s offer is inadequate and urged support for Netflix, according to the Associated Press.

Warner Bros. Rejects Paramount’s $78B Takeover Bid, Backs Netflix Deal

Photo by DeviantArt, CC BY-NC 3.0

Key Takeaways

- Warner Bros. again rejects Paramount’s $78B bid, urges shareholders to back Netflix

- Board cites debt risks and insufficient shareholder protections in rejecting Paramount’s offer

- Shareholders have until Jan. 21 to tender shares

More About the Paramount Deal

As mentioned, Paramount's bid is about $5.9 billion higher, but Warner Bros. is not confident the deal is in the best interests of the company and its shareholders. Thus, Warner Bros. Discovery Chair Samuel Di Piazza Jr. has come out strong against the deal once again.

“Paramount’s offer continues to provide insufficient value, including terms such as an extraordinary amount of debt financing that create risks to close and lack of protections for our shareholders if a transaction is not completed,” Piazza Jr. said in a statement.

He added that the Netflix deal “will offer superior value at greater levels of certainty.”

Warner Bros. Urges Shareholders To Reject Paramount’s Amended Takeover Bidhttps://t.co/o2drSpMVBe pic.twitter.com/5GOfBGghcd

— Forbes (@Forbes) January 7, 2026

Paramount did not immediately comment on the decision to the Associated Press, and shareholders have until Jan. 21 to tender their shares.

Warner Bros. considers this deal a leveraged buyout, meaning that it comes with a lot of debt.

In December, though, Oracle founder Larry Ellison, the father of David Ellison, who's the Paramount CEO, offered up an "irrevocable personal guarantee" to back more than $40 billion in equity for the deal. Additionally, the PAramou

“Paramount has repeatedly demonstrated its commitment to acquiring WBD,” David said in a statement, per the Associated Press, adding that Paramount's offer is “the superior option to maximize value for WBD shareholders.”

Netflix and Paramount Want Different Things

Another wrinkle in this bid is each company's priorities.

Netflix wants Warner Bros. ' studio and streaming business. That includes legacy TV, movie production, and things like HBO Max.

As for Paramount, it wants the entire company, which includes not only what Netflix wants but also networks like Discovery and CNN.

Should Netflix win the deal, the news and cable operations will go off into their own company.

Either way, a merger could take a year or more to complete and will certainly be scrutinized through an antitrust lens.

While this is all going on, Cinema United, a group representing more than 60,000 movie screens globally, told a Congressional antitrust subcommittee it was "deeply concerned" about a deal with Netflix, which could harm the movie theater business. As for Paramount, it said its concerns were "no less serious."

Richard Janvrin is a graduate of the University of New Hampshire. He started writing as a teenager before breaking into sports coverage professionally in 2015. From there, he entered the iGaming space in 2018 and has covered numerous aspects, including news, reviews, bonuses/promotions, sweepstakes casinos, legal, and more.

Related News

BGaming launches Joker X Love slot with high volatility focus

BGaming has expanded its slot portfolio with Joker X Love, a high-volatility release that blends traditional Joker themes with multipliers and bonus-driven gameplay

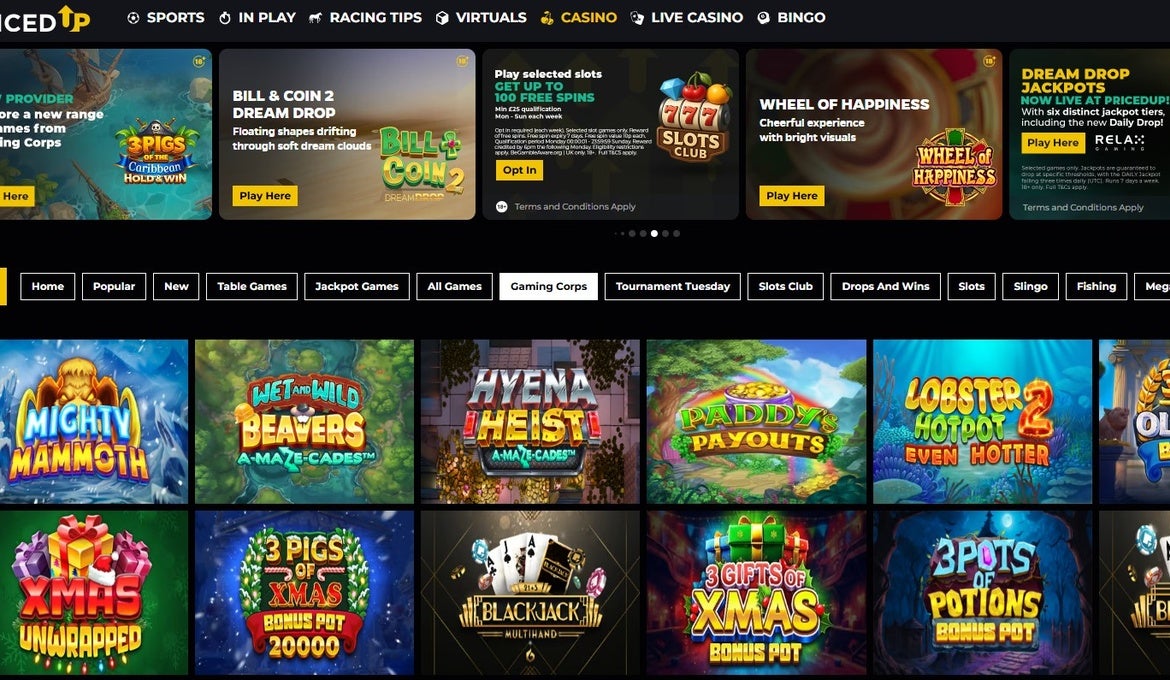

PricedUp adds Gaming Corps content in new UK deal

UK operator PricedUp has signed a new content agreement with Gaming Corps, expanding its online casino portfolio with additional slots and crash-style titles.